- Daily Metals Mining Rundown - Free (Intraday TSX)

- Posts

- Daily Metals Mining Rundown for 15 July 2025 (after-market TSX)

Daily Metals Mining Rundown for 15 July 2025 (after-market TSX)

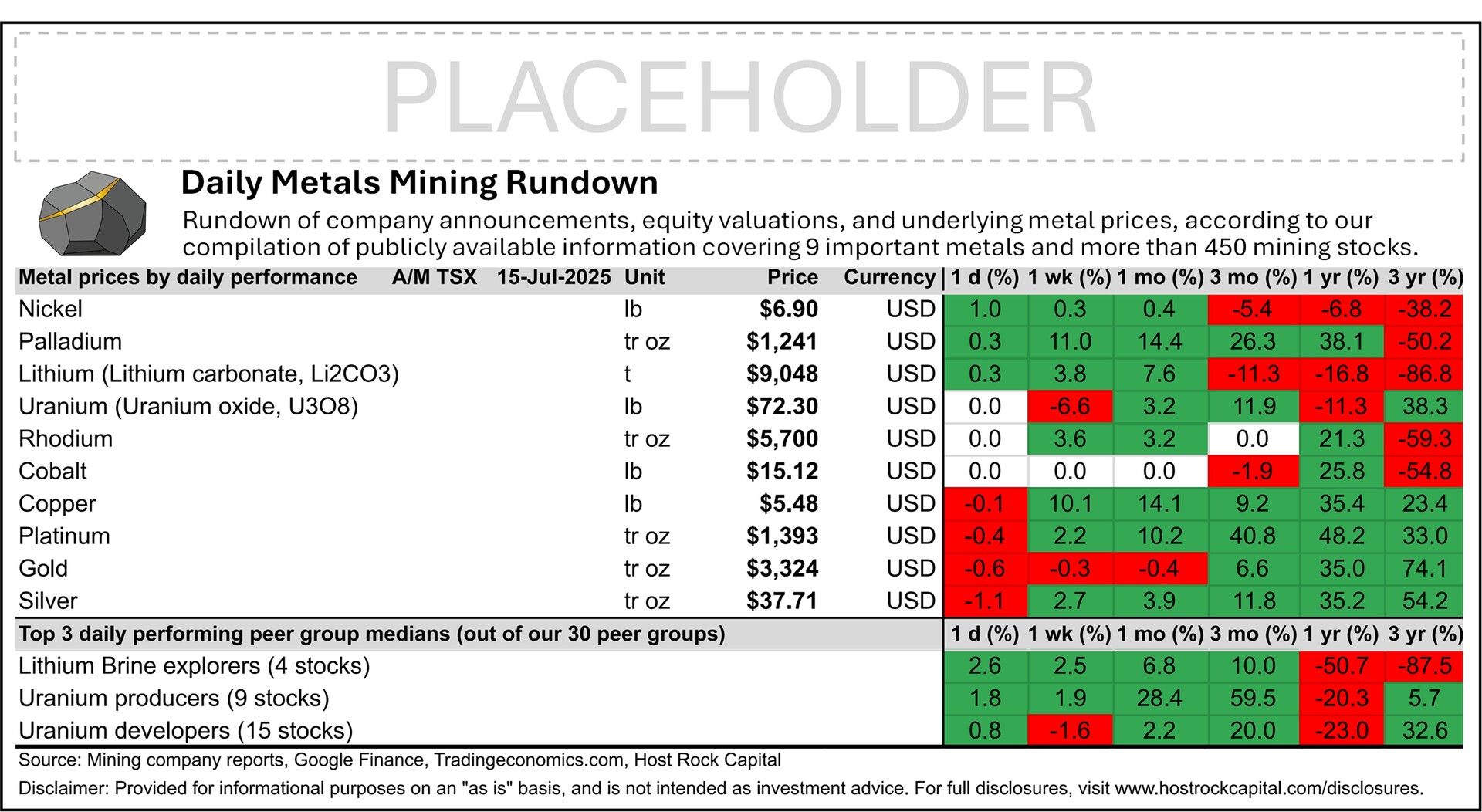

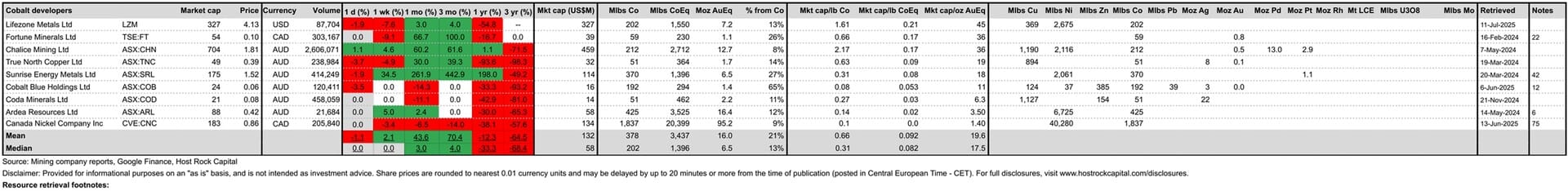

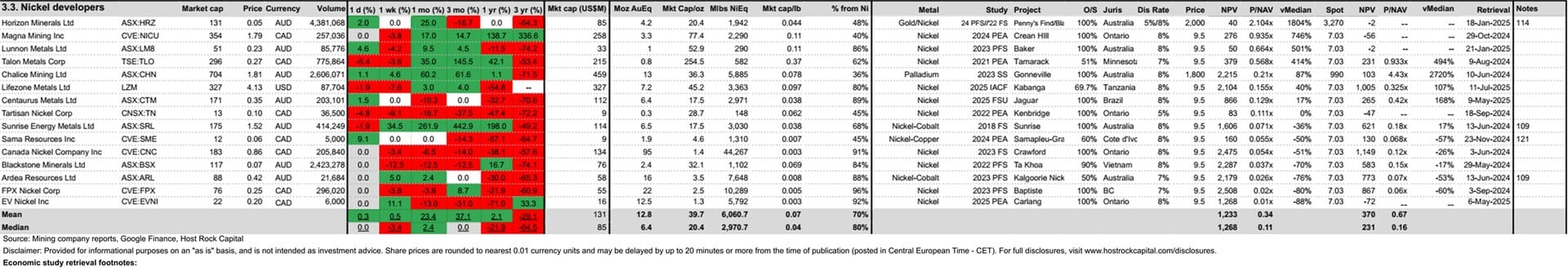

Nickel price rises through TSX trading while lithium flatlines and other metals dip slightly; Larger cap uranium stocks inched higher while most other mining stocks went sideways or down slightly. Covered announcements include resource estimates for two new deposits by Canada Nickel Company (TSXV:CNC).

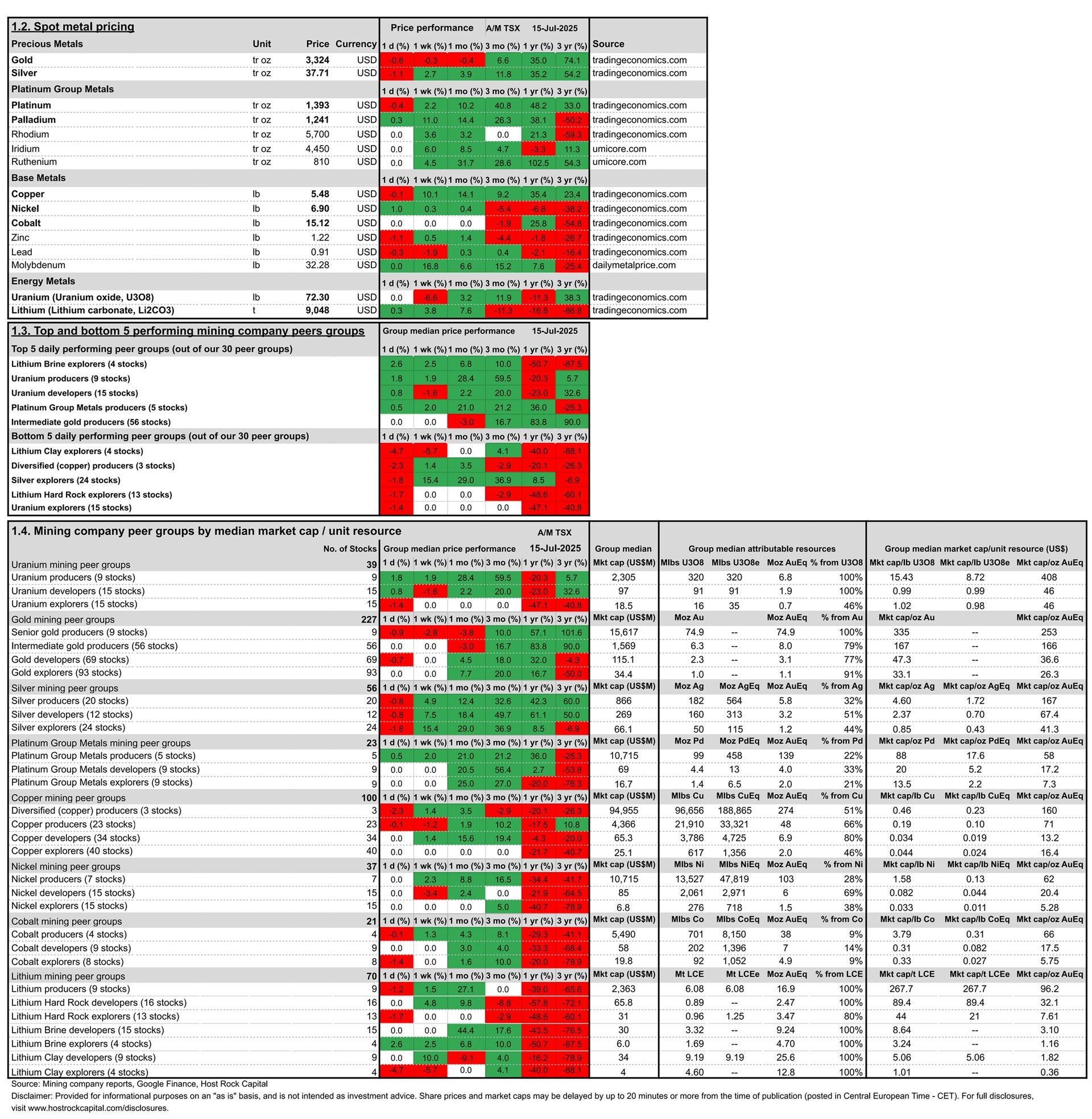

Today’s metal price movements (over past ~24 hrs) and mining company peer group movements through TSX/NYSE trading (including earlier ASX movements) include:

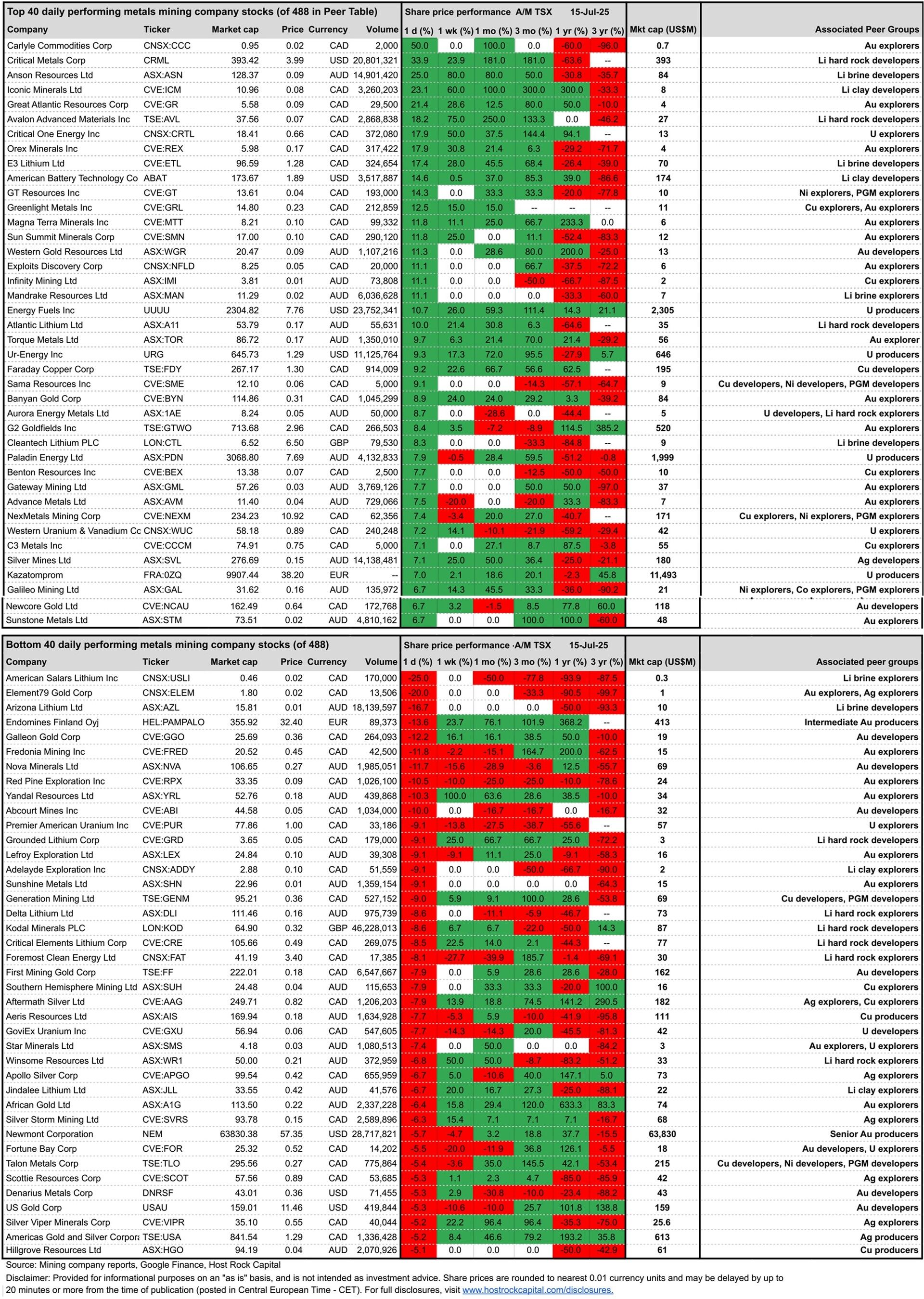

Top and bottom 40 daily performing metals mining company stocks (out of 488 in our Peer Table) through TSX/NYSE trading (including earlier ASX closing prices) include:

Covered mining company announcements incorporated into today’s after-market TSX Peer Table (resource updates, economic studies, changes in attributable project ownership) include:

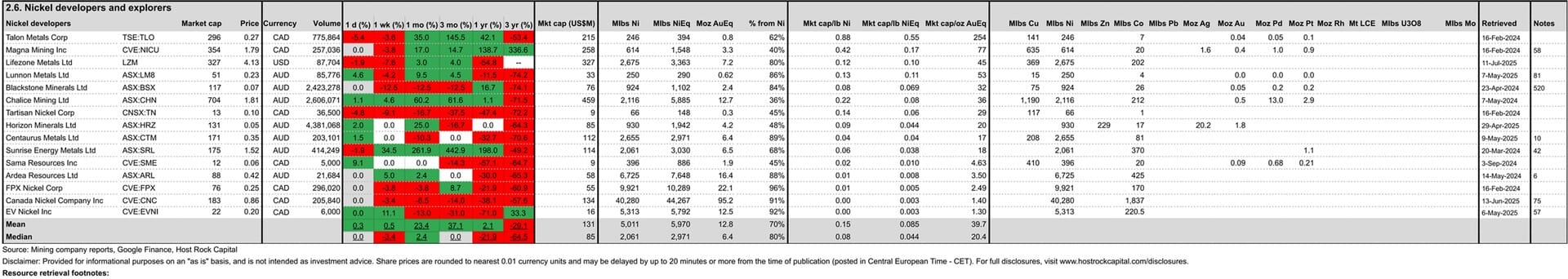

15 July 2025 - Nickel and cobalt developer Canada Nickel Company (TSXV:CNC) announced initial resources at its 80%-owned Mann Central project and 100%-owned Textmont project, both in Ontario. These account for the 5th and 6th deposits uncovered by CNC across its Timmins Nickel District. Mann Central resource contained 1.1Blbs Ni @ 0.22% Ni and 62Mlbs Co @ 0.012% Co (indicated) and 2.5Blbs Ni @ 0.21% Ni and 145Mlbs Co @ 0.012% Co, which are 80% attributable to CNC, and the estimate also included an exploration target to further double to triple this. Textmont resource contained a higher-grade 240Mlbs Ni @ 0.29% Ni and 9.5Mlbs Co @ 0.011% Co (measured and indicated) and 317Mlbs Ni @ 0.25% Ni and 13Mlbs Co @ 0.011% (inferred). Thes two new deposits grows CNC’s combined attributable resources by ~18% to 44.3 Blbs NiEq (91% from Ni, 9% Co), but CNC stock traded surprisingly flat today (15 July) after this news +0% to C$0.86/sh, basic market cap (assuming 213.25m basic shares post completion of recent financings) of C$183m and market cap/lb resource of US$0.003/lb NiEq or $0.007/lb CoEq ($1.30/oz AuEq) for this largest-in-class inventory of nickel resources - a 93% discount to our 15-company nickel developer peer group median US$0.044/lb NiEq ($20.4/oz AuEq) and a 92% discount to our 9-company cobalt developer median $0.082/lb CoEq ($17.5/oz AuEq). On P/NAV from flagship Crawford 2023 feasibility study at our reference nickel price of US$9.5/lb Ni, CNC trades at (market cap/post-tax NPV) of 0.054x - a 51% discount to nickel developer group median 0.11x.

Disclaimer: Provided for informational and educational purposes, and is not intended as investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.