- Daily Metals Mining Rundown - Free (Intraday TSX)

- Posts

- Daily Metals Mining Rundown for 18 Nov 2025 (after-market TSX)

Daily Metals Mining Rundown for 18 Nov 2025 (after-market TSX)

Lithium continued rising thru NA trading, and was joined by silver, gold, platinum, nickel; Some lithium and silver stocks looks good while most other metals miners were flat or down; Covered announcements include an initial resource for Levock project by Magna Mining and a PFS update for Springpole by First Mining.

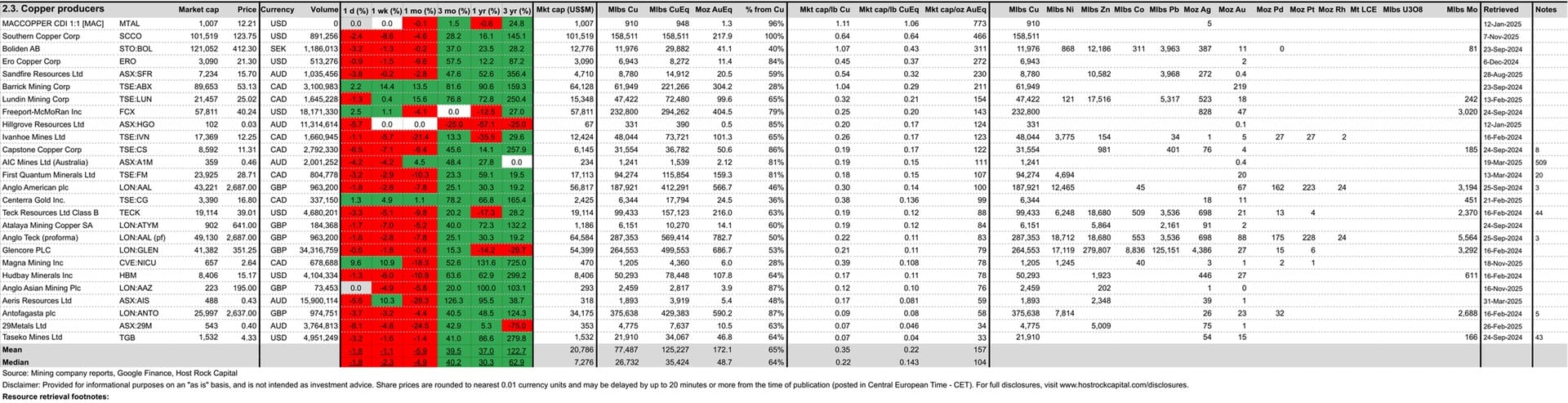

Today’s metal price movements (over past ~18hrs) and mining company peer group movements through TSX/NYSE trading (including earlier ASX movements):

Top and bottom 40 daily performing metals mining company stocks (out of 504 in our Peer Table) through TSX/NYSE trading (including earlier ASX closing prices):

Covered company announcements incorporated into today’s after-market TSX Peer Table (resource updates, economic studies, changes in attributable project ownership):

18 Nov 2025 - Copper, nickel, and PGM producer Magna Mining (TSXV:NICU) announced an initial mineral resource estimate for its high-grade Cu-Ni-PGM Levock past-producing mine project located near Glencore’s (LON:GLEN) Strathcona mill outside of Sudbury, Ontario, which totaled 6.1Mt M&I @ 3.5% CuEq including 1.1% Cu, 1.4% Ni, 0.6 g/t Pt, 0.7g/t Pd, 0.1g/t Au, 2.0 g/t Ag and 5.2 Mt Inferred @ 3.6 % CuEq including 1.2% Cu, 1.4% Ni, 0.6 g/t Pt, 0.8g/t Pd, 0.2 g/t Au, 2.1 g/t Ag. The estimate will form the basis for a PEA and recommissioning decision as early as Q1/26. Together with mineral resources from the company’s producing McCreedy West mine, and its PEA-stage Crean Hill, FS-stage Shakespeare, and resource-stage Podolsky projects (all also near Sudbury), this announcement grows Magna’s overall resources by 20% to 4.4 Blbs CuEq or 3.0Blbs NiEq or 19Moz PdEq (6.0Moz AuEq), 41% from Ni, 28% from Cu, 10% from Pt, 9% from Pd. Magna stock rose +10% today (18 Nov) following this news to C$2.64/sh, market cap C$659m, and market cap/lb resource US$0.108/CuEq ($80/oz AuEq) - a 24% discount to our 34-company copper producer group median $0.143/lb CuEq ($104/lb CuEq).

18 Nov 2025 - Gold developer First Mining (TSX:FF) announced updated PFS results for its Springpole project in Ontario, which included updates to infrastructure stemming from the ongoing provincial and federal EA processes, for which talks with indigenous are ongoing. So while capex was somewhat higher higher compared to 2021 PFS, the design is tighter and more closely resembled what will be permitted and built, and AISC remained low at $938/oz over LOM. Reported After-tax NPV5% was US$2.1b at US$3,100/oz from initial capital US$1.1b. FF’s combined NPV (together with 2023 PEA for Duparquet project in Quebec) fell by ~19% on this announcement to ~US$5.5b at our 3-month trailing average gold price US$3,467/oz. FF stock traded down -5.5% today (18 Nov) following this news (vs. gold developer mean down -0.7%) to C$0.35/sh, market cap C$452m, and P/NAV (from both projects) of 0.059x - a 58% discount to gold developer group median 0.14x.

Disclaimer: Provided for informational and educational purposes on an “as-is” basis, and is not investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.