- Daily Metals Mining Rundown - Free (Intraday TSX)

- Posts

- Daily Metals Mining Rundown for 20 Nov 2025 (after-market TSX)

Daily Metals Mining Rundown for 20 Nov 2025 (after-market TSX)

Metal prices were largely flat thru NA trading, while rhodium inched higher and lithium remained elevated from ASX trading, which helped NA listed Li stocks play catch up; Coverage includes resources update by Independence Gold for 3Ts project in BC and increased ownership for Colombian development project by Aris Mining.

Today’s metal price movements (over past ~24hrs) and mining company peer group movements through TSX/NYSE trading (including earlier ASX movements):

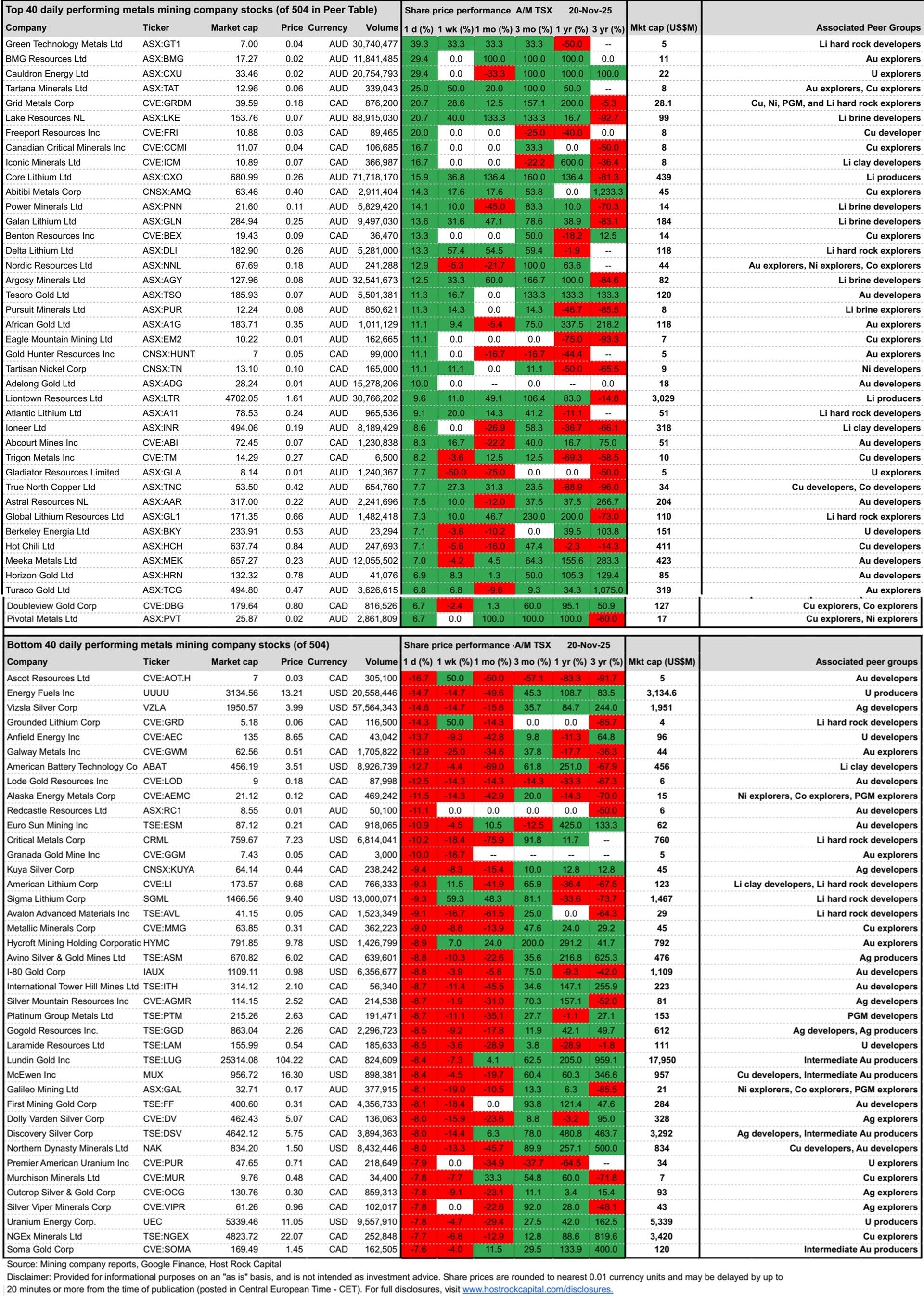

Top and bottom 40 daily performing metals mining company stocks (out of 504 in our Peer Table) through TSX/NYSE trading (including earlier ASX closing prices):

Covered company announcements incorporated into today’s after-market TSX Peer Table (resource updates, economic studies, changes in attributable project ownership):

20 Nov 2025 - Intermediate gold producer Aris Mining (TSX:ARIS) announced it has entered into a binding term sheet to acquire the remaining 49% interest in the Soto Norte development project in Colombia, where it has ongoing gold production from its Segovia mine. The deal grows ARIS’ M&I resources by +3.4Moz consideration of US$80m ($60m cash, $20m shares at US$11.50/sh) which translates to US$23.5/oz M&I - a fair price for both parties, and most importantly this deal positions ARIS for growth and to become a 1,000,000 oz pa producer from full ownership of producing Segovia, and pipeline projects Marmato, Toroparu, and now also Soto Norte. Somewhat surprisingly, ARIS traded down -3.7% today (20 Nov, intraday) following this news - underperforming our intermediate gold producer median -2.4% (intraday), to share price C$16.11, (proforma) market cap C$3.3b, and proforma market cap/oz resource of US$72/oz Au (based on ARIS’ M&I&I resources which grew by 22% on this deal to 32.6Moz) - a steep 68% discount to our 58-company gold producer median US$227/oz AuEq.

20 Nov 2025 - Gold explorer Independence Gold (TSXV:IGO) announced a significant update to its mineral resource estimate for its flagship 3Ts project in BC. The update grew open pit and underground gold equivalent resources by roughly 10% to 0.765 Moz (78% from Au, 22% from Ag - at 3-month trailing average metal pricing), and for the first time includes an indicated category - paving the way for a future reserve. IGO stock traded flat +0% today (20 Nov, intraday) following this news to 10c/sh, market cap C$20m, and market cap/oz resource US$19/oz AuEq - a steep 57% discount to 93-company gold explorer group median $44/oz AuEq.

Disclaimer: Provided for informational and educational purposes on an “as-is” basis, and is not investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.