- Daily Metals Mining Rundown - Free (Intraday TSX)

- Posts

- Daily Metals Mining Rundown for 20 Oct 2025 (intraday TSX)

Daily Metals Mining Rundown for 20 Oct 2025 (intraday TSX)

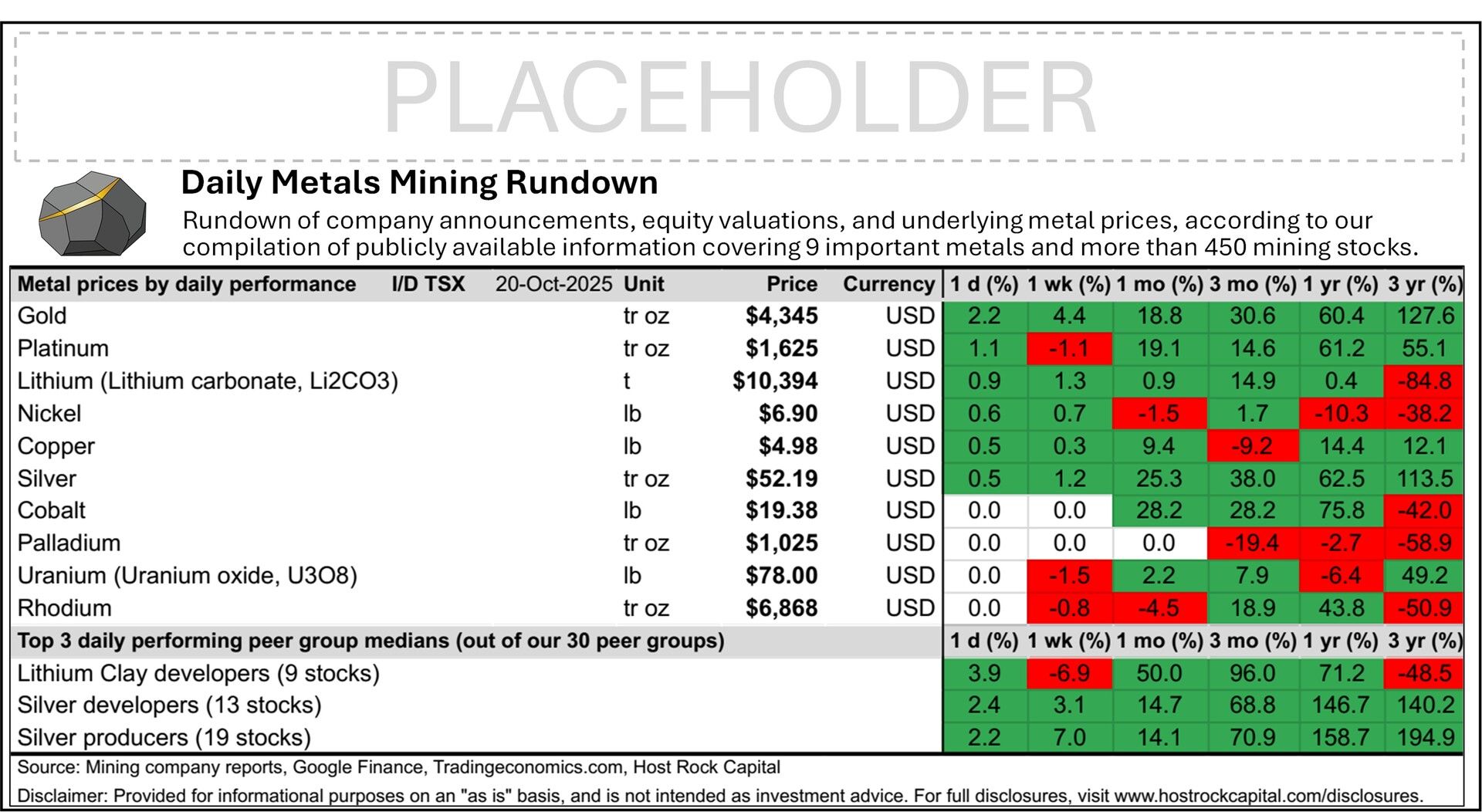

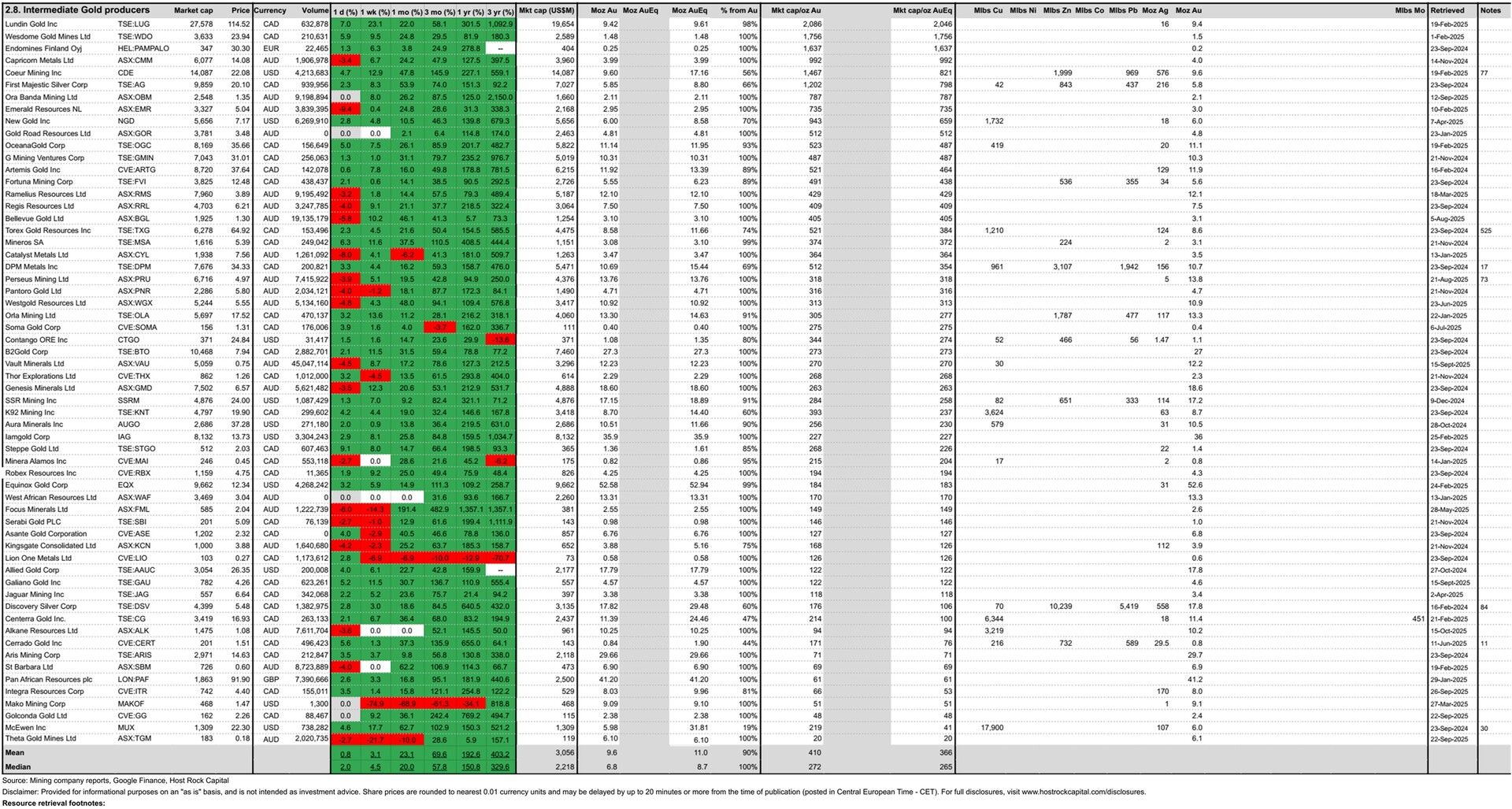

Gold and silver prices continued rising intraday TSX, led by gold now up +2.2% near all time highs, and now also joined by platinum, copper, and nickel; Most North American metals mining stocks are up, ex-Uranium; PFS was announced by Arizona Sonoran Copper and Northern Superior Resources announced acquisition by Iamgold.

Today’s metal price movements (since Friday’s close) and mining company peer group movements intraday TSX/NYSE (including earlier ASX movements) include:

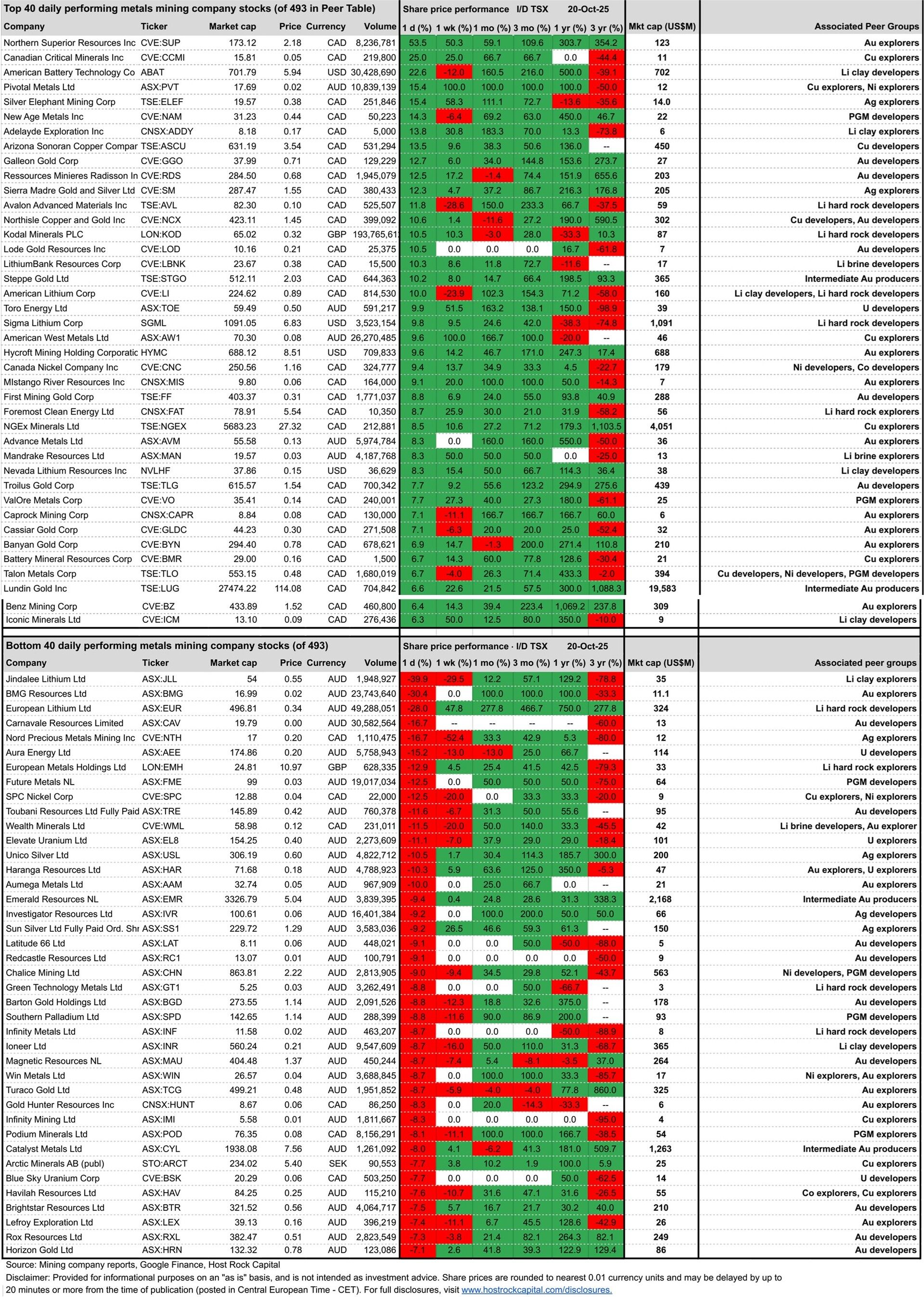

Top and bottom 40 daily performing metals mining company stocks (out of 493 in our Peer Table) intraday TSX/NYSE (including earlier ASX closing prices) include:

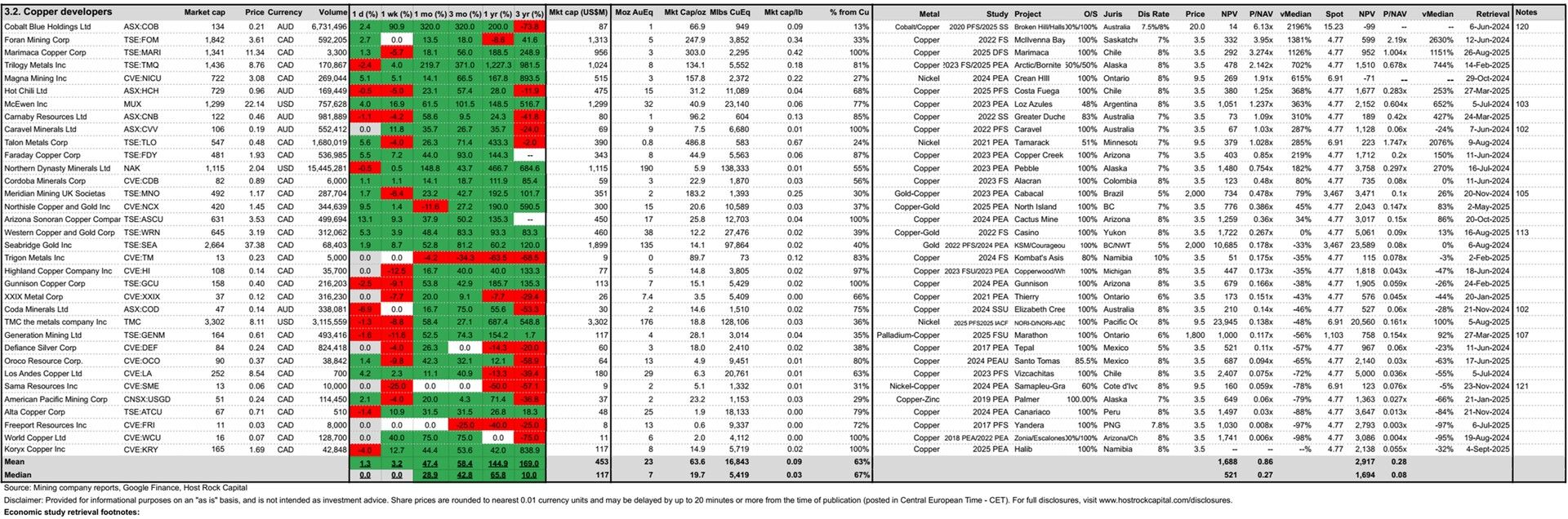

Covered mining company announcements incorporated into today’s intraday TSX Peer Table (resource updates, economic studies, changes in attributable project ownership):

20 Oct 2025 - Copper developer Arizona Sonoran Copper (TSXV:ASCU) announced PFS results for its flagship Cactus project outlining a long-life, low-cost operation in Arizona. The NPV took a slight hit compared to the old 2024 PEA, as might be expected from this key with maiden ore reserve more refined cost estimates. Reported post-tax NPV was US$2.3b at base case $4.25/lb from initial capital of $977m for conventiona open pit heap leach with SXEW with LOM all in operating coosts of $2.01/lb. ASCU stock gained +12% today (20 Oct intraday) following this announcement, to C$3.49/sh, market cap C$633m, and P/NAV 0.36x at our reference copper price $3.50/lb - in between our 34-company copper developer median and mean 0.26x and 0.8x (at same $3.50/lb).

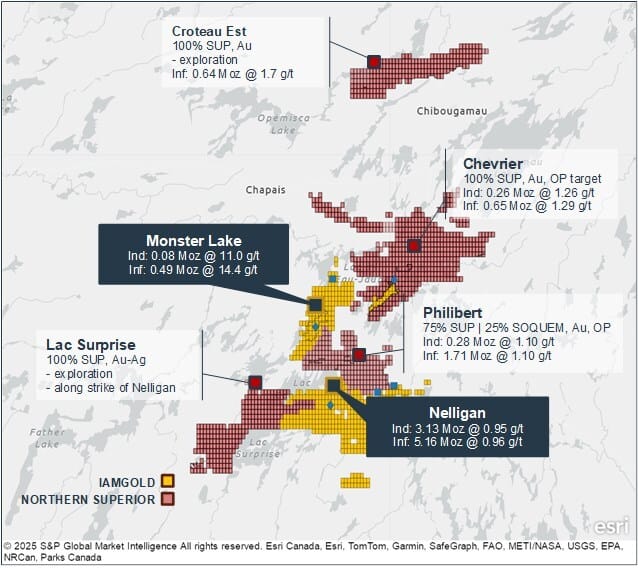

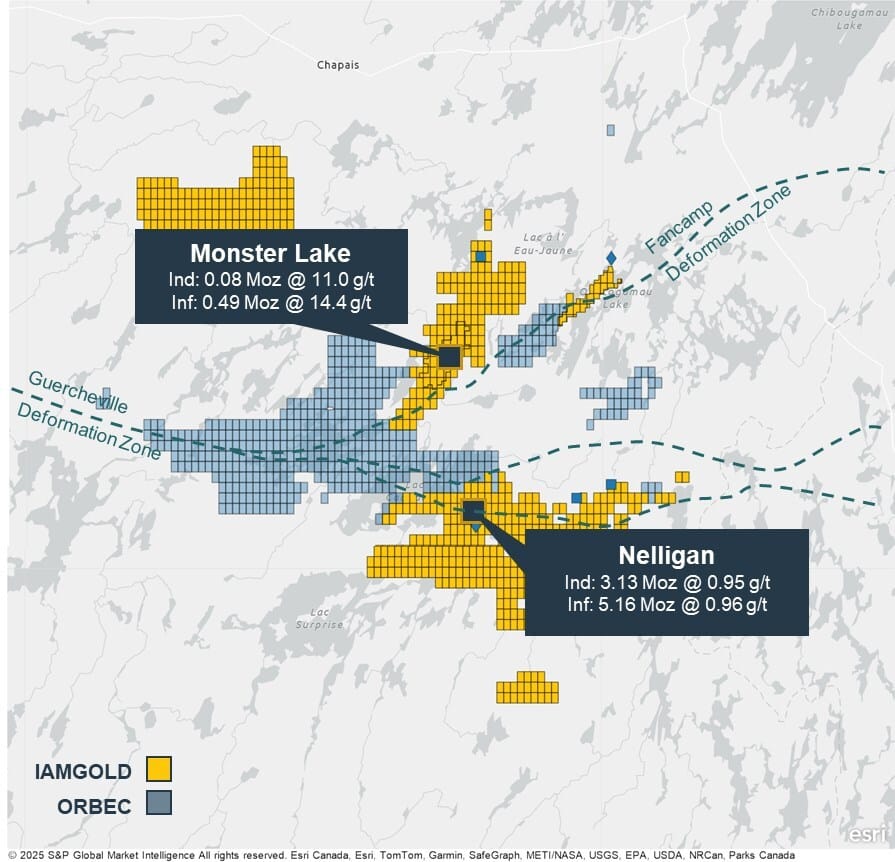

20 Oct 2025 - Intermediate gold producer Iamgold (NYSE:IAG) announced the acquisition of two juniors with properties that are contiguous and/or near to its existing 8.3Moz Nelligan and 0.57Moz Monster Lake gold properties: (1) gold explorer Northern Superior (TSXV:SUP) with its 3Moz attributable ounces spread across Chevrier (100% owned by SUP), Philibert (75%), and Croteau Est (100%), and (2) early-stage (pre-resource) gold explorer D’Or Orbec Inc. (TSXV:BLUE) with its prospective Muus property. SUP shareholders will receive 0.0991 IAG shares and C$0.19 cash for each share of SUP (roughly ~90% shares, 10% cash), for a 27.4% premium to 20-day VWAP. IAG and SUP to own 97% and 3% of pro forma company. IAG basic shares to increase by +3.0% to ~592.26 while its attributable mineral resource inventory will increase by ~+9.5% to 35.9Moz - making the deal accretive for IAG shareholders on resource ounces per share IAG. IAG traded up +3.6% today (20 Oct intraday) to US$13.76/sh, pro forma market cap US$8.1b, and market cap/oz resource is reduced by this deal to US$227/oz Au - now a 14% discount to our 60-company intermediate gold producer median US$265/oz AuEq.

Disclaimer: Provided for informational and educational purposes on an “as-is” basis, and is not investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.