- Daily Metals Mining Rundown - Free (Intraday TSX)

- Posts

- Daily Metals Mining Rundown for 3 Nov 2025 (after-market TSX)

Daily Metals Mining Rundown for 3 Nov 2025 (after-market TSX)

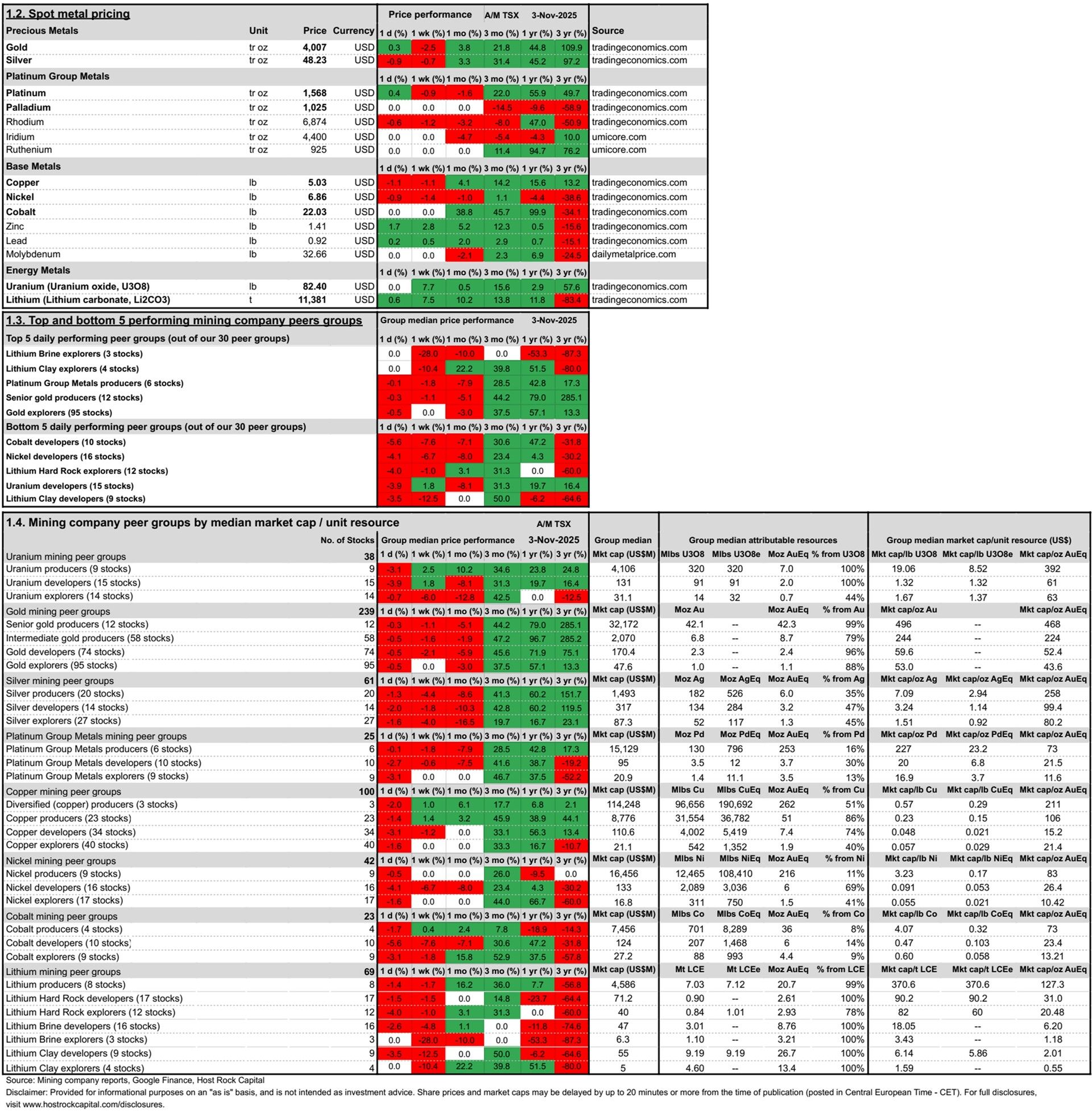

Gold price inched slightly higher over weekend - back above $4,000/oz, while lithium and platinum prices also rose, and copper, nickel, silver all fell; Metals mining stocks went mostly sideways or down slightly today; Coeur Mining surprisingly sold off after announced acquisition of New Gold, and Denarius Metals announced a resource update for Colombian project.

Today’s metal price movements (since Friday’s close) and mining company peer group movements through TSX/NYSE trading (including earlier ASX movements):

Top and bottom 40 daily performing metals mining company stocks (out of 500 in our Peer Table) through TSX/NYSE trading (including earlier ASX closing prices):

Covered company announcements incorporated into today’s after-market TSX Peer Table (resource updates, economic studies, changes in attributable project ownership):

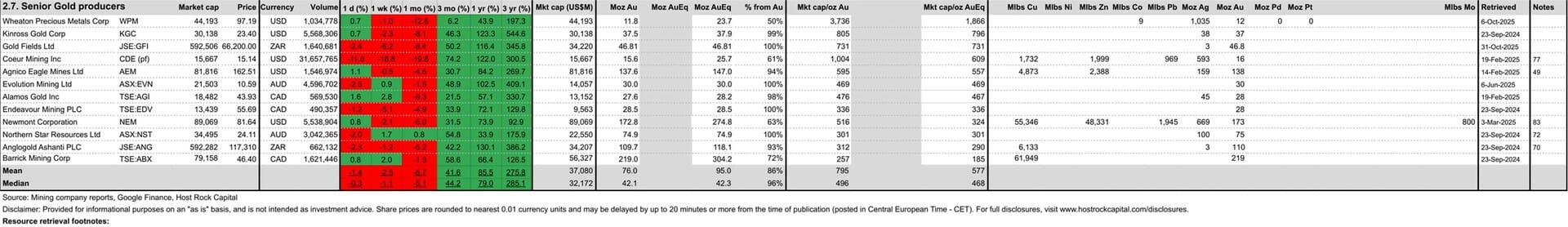

3 Nov 2025 - Silver producer and intermediate gold producer Coeur Mining (NYSE:CDE) announced the acquisition of intermediate gold producer New Gold (NYSE:NGD) in an all-stock US$7b deal, which includes a 16% premium to NGD’s last price. NGD shareholders are to receive 0.4959 shares CDE per NGD share and will own 28% of combined company (CDE 62%). CDE gets NGD’s mineral resources of ~8.6Moz AuEq (including 2 producing mines in Canada), which are 70% from Au, 27% from Cu, and 3% from Ag (with no recovery factors at our 3-month trailing average metal pricing) for a price of US$785/oz AuEq, which initially sounds pricey relative to intermediate gold producer median $224/oz AuEq and even to CDE’s prior (31 Oct) market cap/oz of US$638/oz. Stemming in part from these initial optics, CDE stock sold off today by -13% today to US$14.94/sh and pro forma market cap US$15b. But based on simple equating of NAV multiples, we ultimately exepct CDE stock to gain by as much as ~50% on this deal. Here’s why: We’d expect an intermediate gold producer to trade at NAV multiple (P/NAV or price-to-net-asset-value) around ~1x, whereas we’d expect a SILVER dominant precious metals producer or SENIOR GOLD producer to receive a NAV premium of up to +1x, for a 2x NAV multiple overall. CDE looks like had already warranted this ~2x NAV multiple from its high 38% of resources (and similarly high share of production) coming from silver (based on CDE’s market cap/oz AuEq resource being more than double intermediate gold producer group median). BUT there is a special sweet spot implied here, IF a company can achieve BOTH: (1) Silver dominance, AND (2) Senior gold producer status, this company should warrant multples as high as ~3x! This type of multiple has recently only been reserved for the likes of Wheaton Precious Metals (NYSE:WMP) with its 50% of resource metal value (and high share of production) coming from silver, which helps WPM trade at the very top of the senior gold producer pack on market cap/oz resource. That’s what this deal is about for CDE, which now graduates to our SENIOR GOLD PRODUCER peer group (and also remains a SILVER PRODUCER with it’s (still) relatively high 26% of metal value coming from silver - second only to WPM in senior gold group), and so CDE’s warranted NAV multiple could increase by as much as 50% from ~2x to ~3x. A 50% rise from CDE’s (3 Nov) proforma market cap/oz AuEq of US$609/oz AuEq (at US$15.14/sh) would yield US$911/oz (not even HALF of WPM’s existing US$1,866/oz AuEq). The good folks on Bay Street SHOULD have picked this up (altough they tend to be overly-obsessed with cash flow multiples, so might have missed it 😉). NAV incorporates cash flow, but also reserves/resources replacement, and is better for rules of thumb and comparisons between peer groups (AND is more proportionate to market cap/oz resource, which is handy vis a vis our Peer Table).

3 Nov 2025 - Gold developer Denarius Metals Corp (DNRSF) announced an updated resource for its 100%-owned Zancudo project in Colombia, following 7,225m of drilling completed in the Company’s 2024 drill campaign. The deposit strikes for 2,500m with known vertical extent of 400m, and remains open for further expansion in all directions. The update used a slightly lower cutoff grade of 3.25 g/t AuEq (compared to 4g/t AuEq in 2023), which together with new drilling helped grow overall resource tonnage by 37% to 5.6 Mt, including 0.98Mt indicated grading 6.9 g/t Au, 84 g/t Ag (7.9 g/t AuEq). Overall contained metal grew 16% to a reported 1.2Moz AuEq (indicated + inferred). Including the companies other polymetallic projects in Spain, company resource grow by 6% to 3.68 Moz AuEq (50% from Au, 22% from Zn, 12% from Ag, rest Cu-Ni-Pb-Co-Pd-Pt). From combined 2023 PEA for this Zancudo project and 2024 PFS for other Aguablanca project in Spain, Denarius stock trades at P/NAV of 0.15x at our Reference gold price US$2,000/oz Au - a 69% discount to gold developer median 0.48x. On market cap/oz, Denarius trades at US$12.7/oz AuEq, for a 75% discount to gold developer median $52/oz AuEq.

Disclaimer: Provided for informational and educational purposes on an “as-is” basis, and is not investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.