- Daily Metals Mining Rundown - Free (Intraday TSX)

- Posts

- Daily Metals Mining Rundown for 30 July 2025 (intraday TSX)

Daily Metals Mining Rundown for 30 July 2025 (intraday TSX)

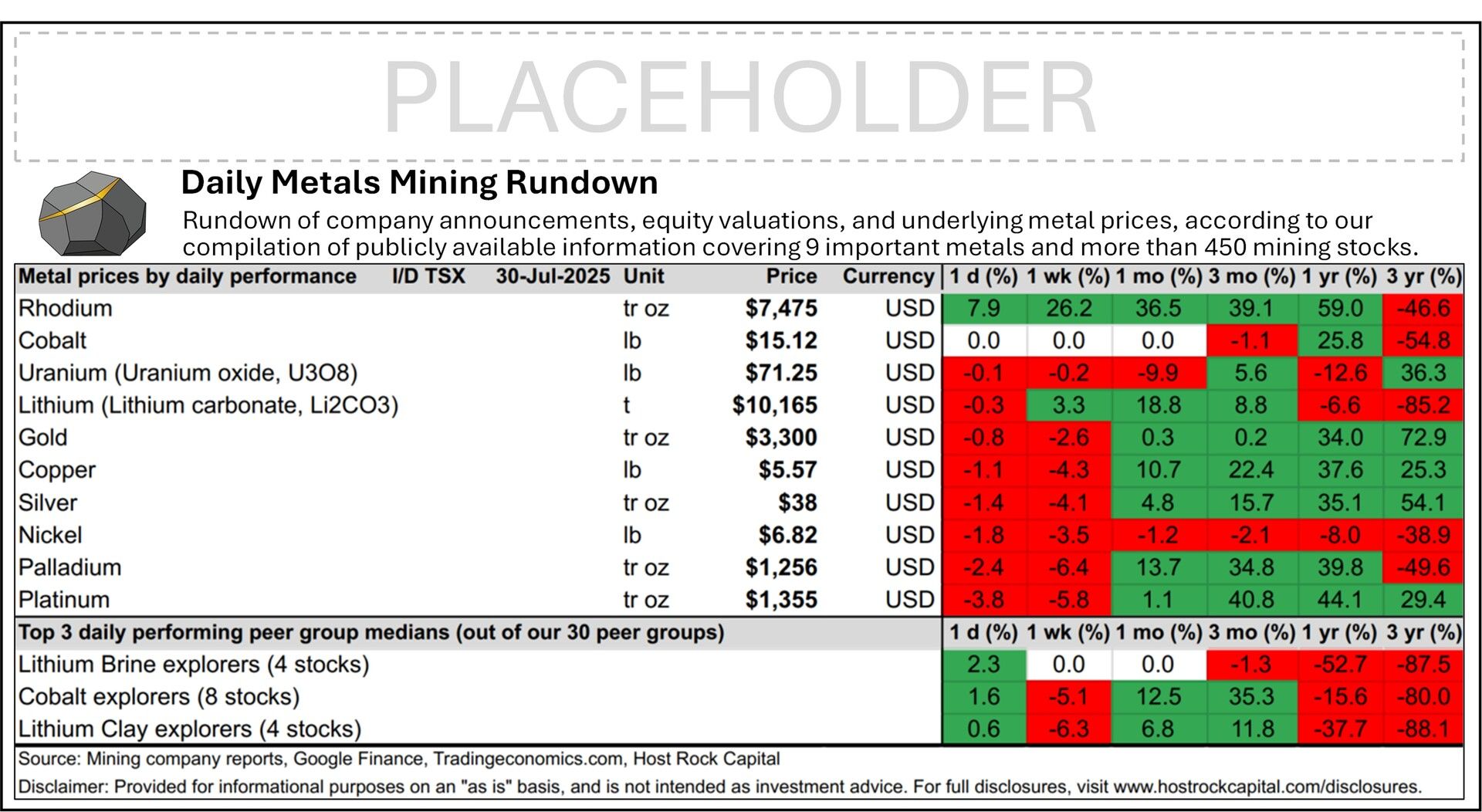

Rhodium is on the rise, up +8% today and 26% over past week; Prices for other metals are down a bit today, while most mining stocks trades sideways to down slightly with silver stocks bearing the brunt of it

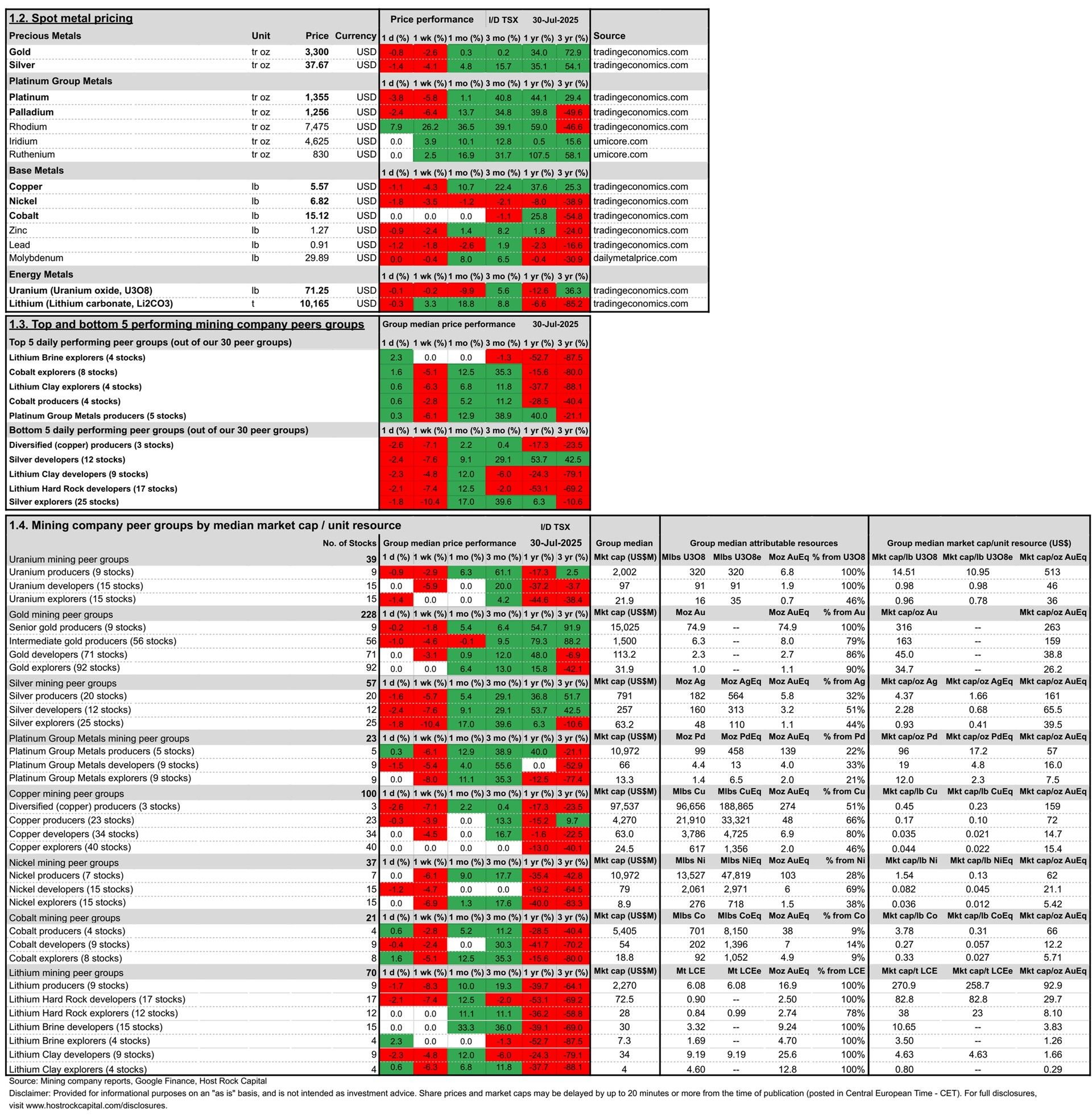

Today’s metal price movements (over past ~24 hrs) and mining company peer group movements intraday TSX/NYSE (including earlier ASX movements) include:

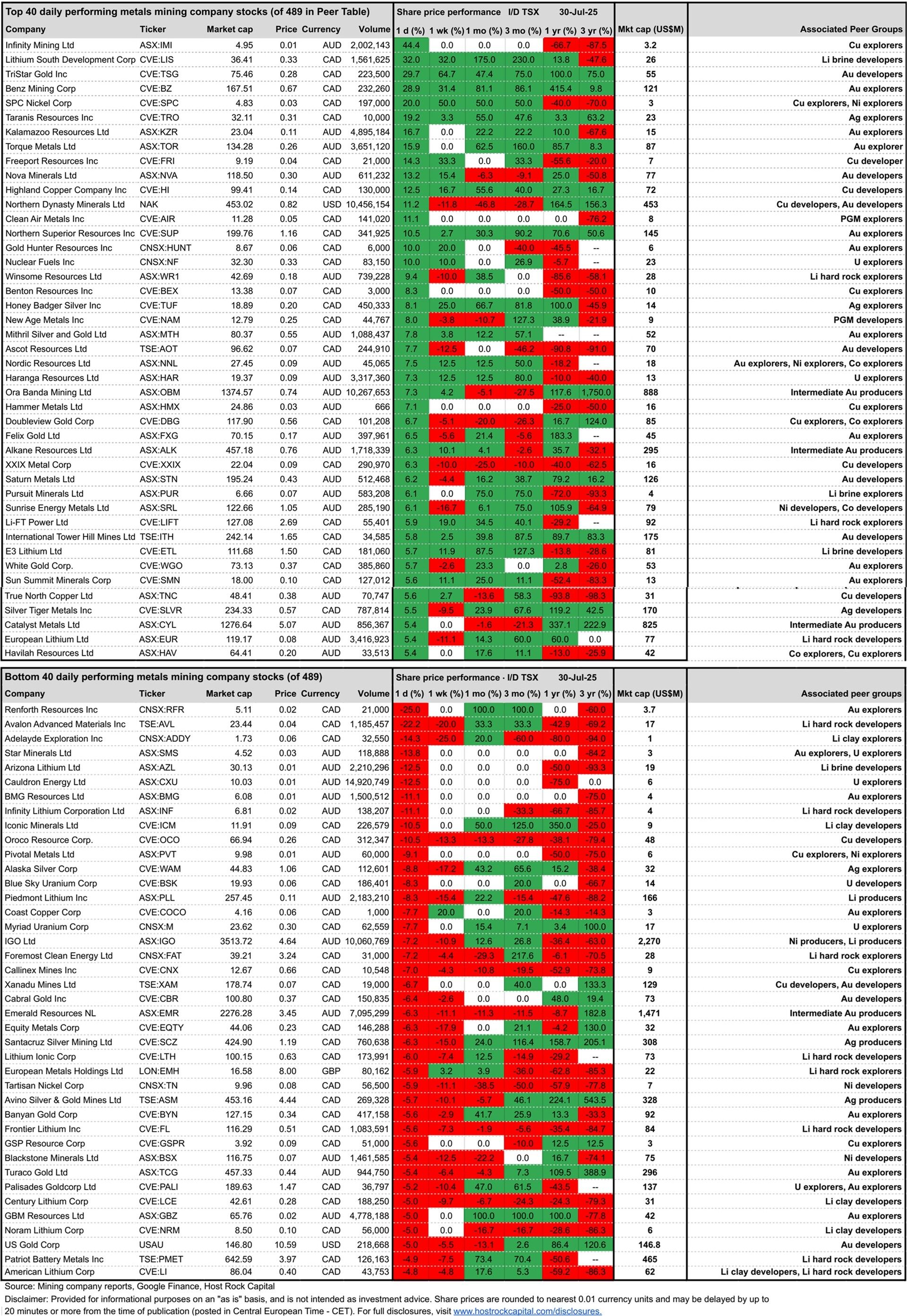

Top and bottom 40 daily performing metals mining company stocks (out of 489 in our Peer Table) intraday TSX/NYSE (including earlier ASX closing prices) include:

Covered mining company announcements incorporated into today’s intraday TSX Peer Table (resource updates, economic studies, changes in attributable project ownership) include:

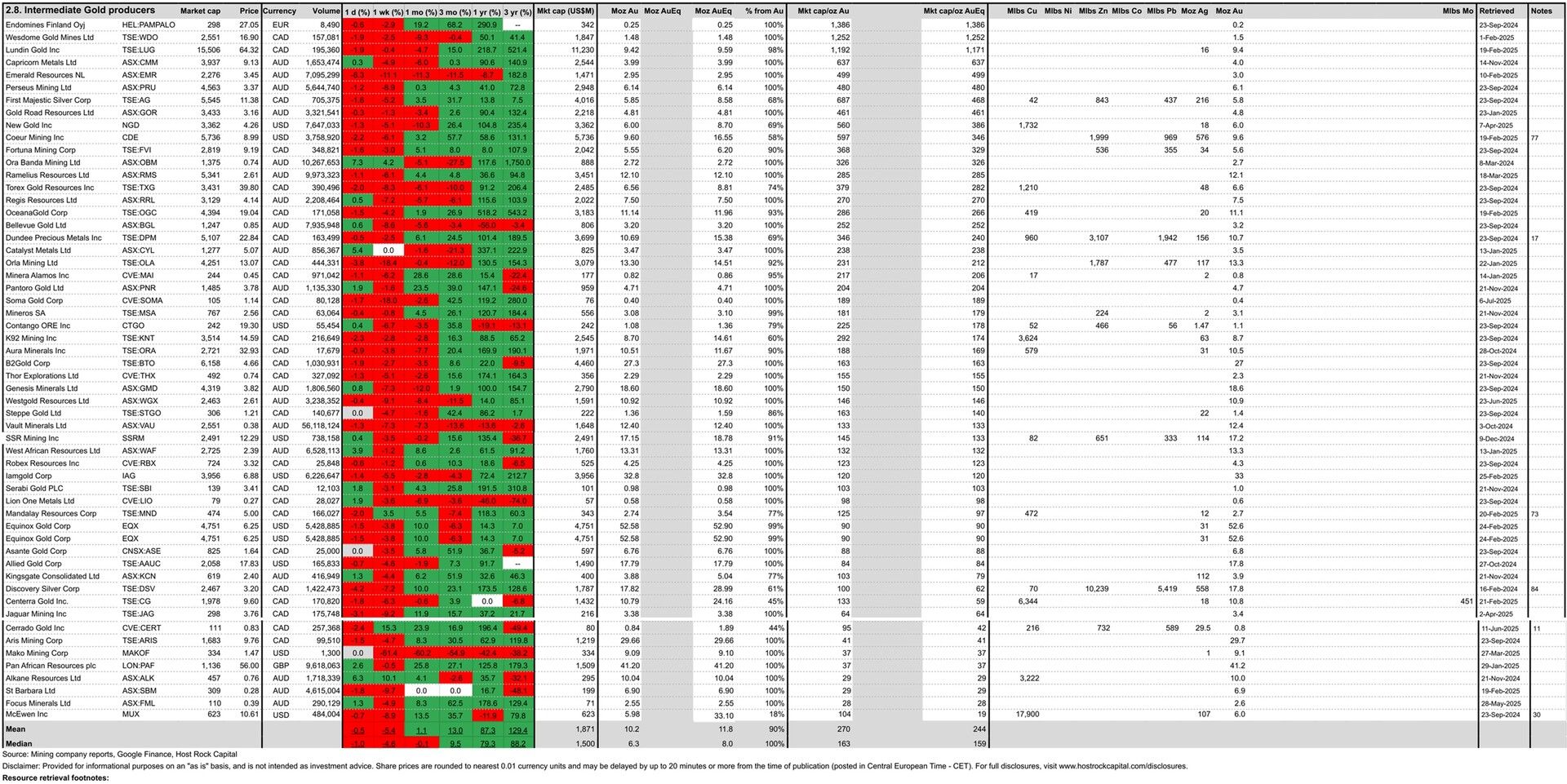

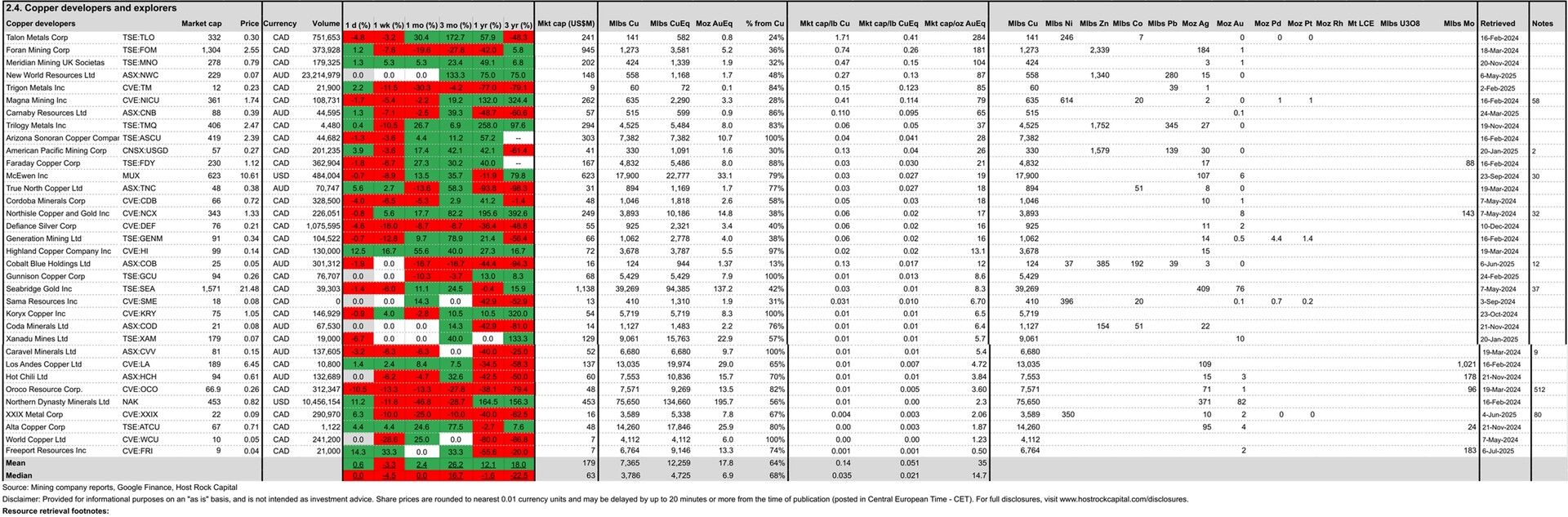

27 Jul 2025 - Intermediate gold producer and copper developer McEwen Mining (NYSE:MUX) announced the acquisition of gold explorer Canadian Gold Corp (TSXV:CGC) in all-stock deal, along with its past-producing Tartan Lake gold mine project, which MUX has the funding capacity to advance through development. MUX gets Tartan’s starter resources of ~0.3 Moz including a high-grade 0.24 Moz @ 6.3g/t in the indicated category. CGC shareholders got a 26% premium to VWAP and are set to receive 0.0225 MUX shares for each CGC share, and are set to own 8.2% of combined company. MUX’s basic shares outstanding to increase from Google Finance’s 54m to 58.7m proforma. MUX shares are down -10% over past week (ending today Wed 30 July) vs. intermediate gold producer median down -5% to US$10.45/sh or pro-forma market cap $613m or (proforma) market cap/oz resource of $19/oz AuEq for its ~33Moz AuEq resources - well below our 56-company intermediate gold producer median $159/oz (or a MUX market cap $103/oz Au for its 6Moz Au gold only, excluding copper). Against copper developer peers (MUX is a producer), MUX trades at US$0.027/lb CuEq - just above our 34-company copper developer group median US0$0.21/lb CuEq and well below mean $0.051/lb CuEq. CGC stock traded flat +0% over past week (ending today 30 July) to C$0.31/sh - vs 92-company mean loss -1%.

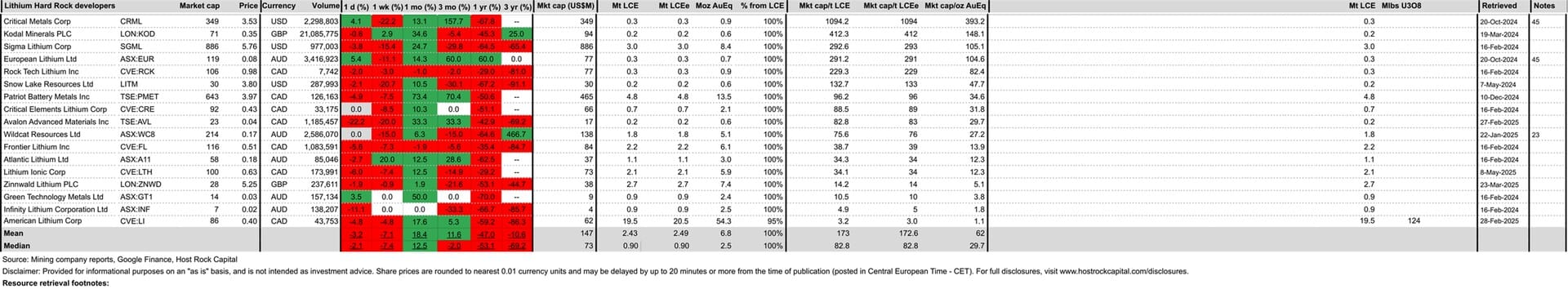

29 July 2025 - Former lithium hard rock explorer - now lithium hard rock developer - Wildcat Resources (ASX:WC8) announced results of a PFS for its 100%-owned Tabba Tabba project in Western Australia, confirming potential for a long-life mine with a post-tax NPV8 of A$1.2b at broker consensus spodumene (6%) price of US$1,384/t spodumene from pre-production capital of A$687m. While we only NAVs for Li hard rock developers with commodities lithium carbonate or hydroxide as a product, WC8’s resources of ~1.8 Mt LCE (~5.1 Moz AuEq) trade at a WC8 market cap/t of US$76/t LCE ($27/oz AuEq) - a 15% discount to our 17-company lithium hard rock developer peer group median $88.5/t LCE (US$31.8/oz AuEq).

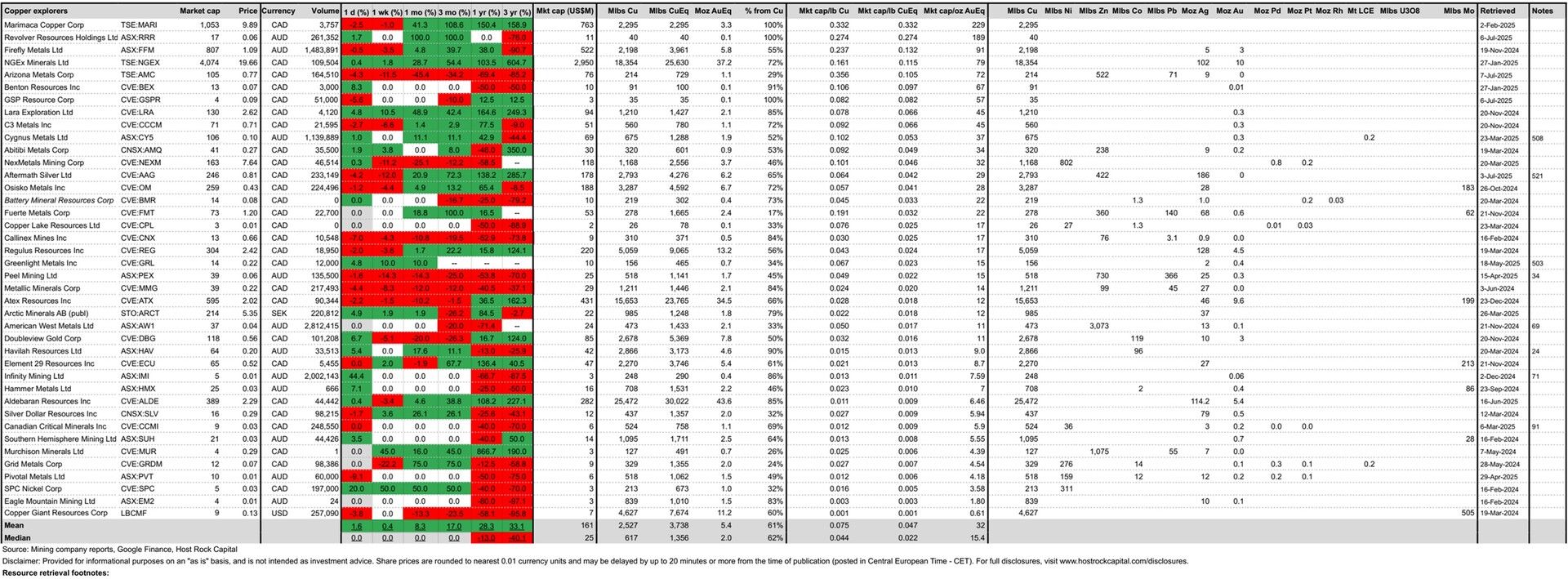

30 July 2025 - Copper explorer Southern Hemisphere (ASX:SUH) announced an updated JORC resource estimate for 218 Mt grading 0.38% CuEq for 496,600 t Cu (1.1 Bt Cu), which included significant conversion to measured and indicated category now amounting to 174Mt grading 0.24% Cu and 0.10% Au. SUH stock traded up +3.5% today (30 July) to ~A$0.03/sh (vs. 40-company copper explorer mean daily performance of +1.4%), a market cap A$21m, and market cap/lb resource of US$0.008/lb CuEq ($5.5/oz AuEq) - a 64% discount to copper explorer median $0.022/lb CuEq ($15.3/oz AuEq).

Disclaimer: Provided for informational and educational purposes, and is not intended as investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.