- Daily Metals Mining Rundown - Free (Intraday TSX)

- Posts

- Daily Metals Mining Rundown for 8 Oct 2025 (after-market TSX)

Daily Metals Mining Rundown for 8 Oct 2025 (after-market TSX)

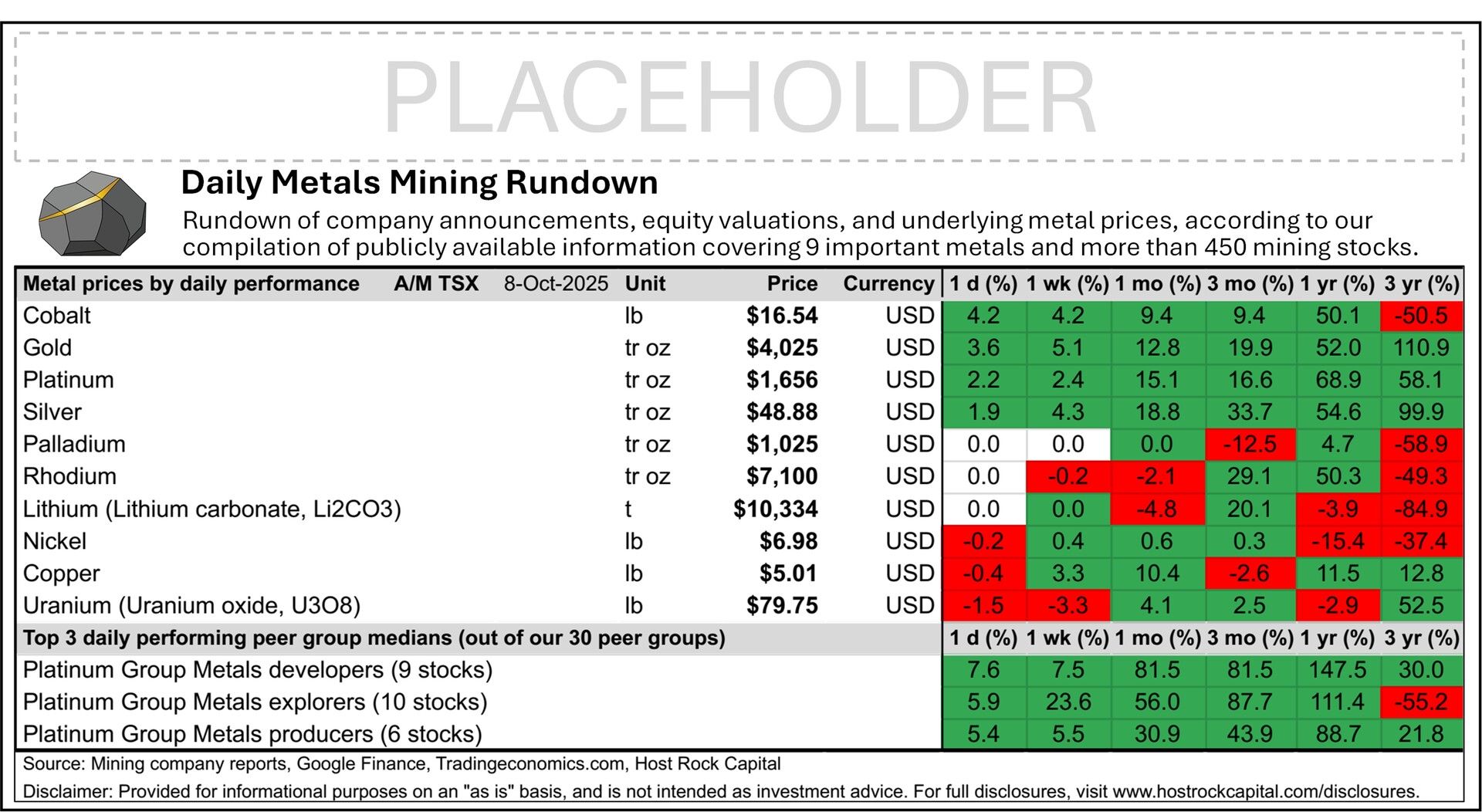

Gold smashed through $4,000/oz today to a new record high, alongside upticks in cobalt, platinum, and silver; PGM mining stocks rose sharply, followed by silver and gold stocks while other miners were largely flat; Updated PEA was announced by P2 Gold that appeared light on capex.

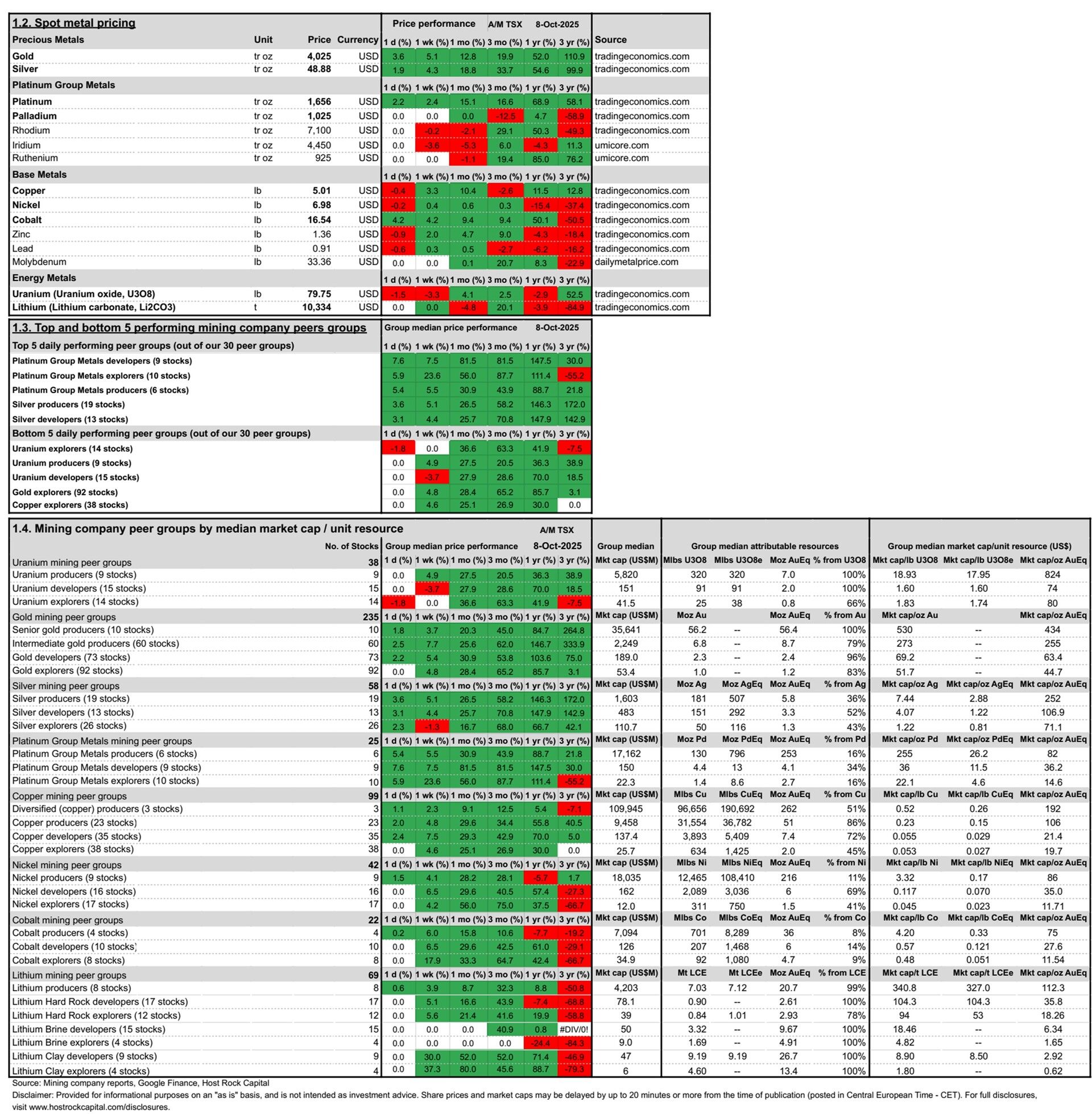

Today’s metal price movements (over past ~24hrs) and mining company peer group movements intraday TSX/NYSE trading (including earlier ASX movements) include:

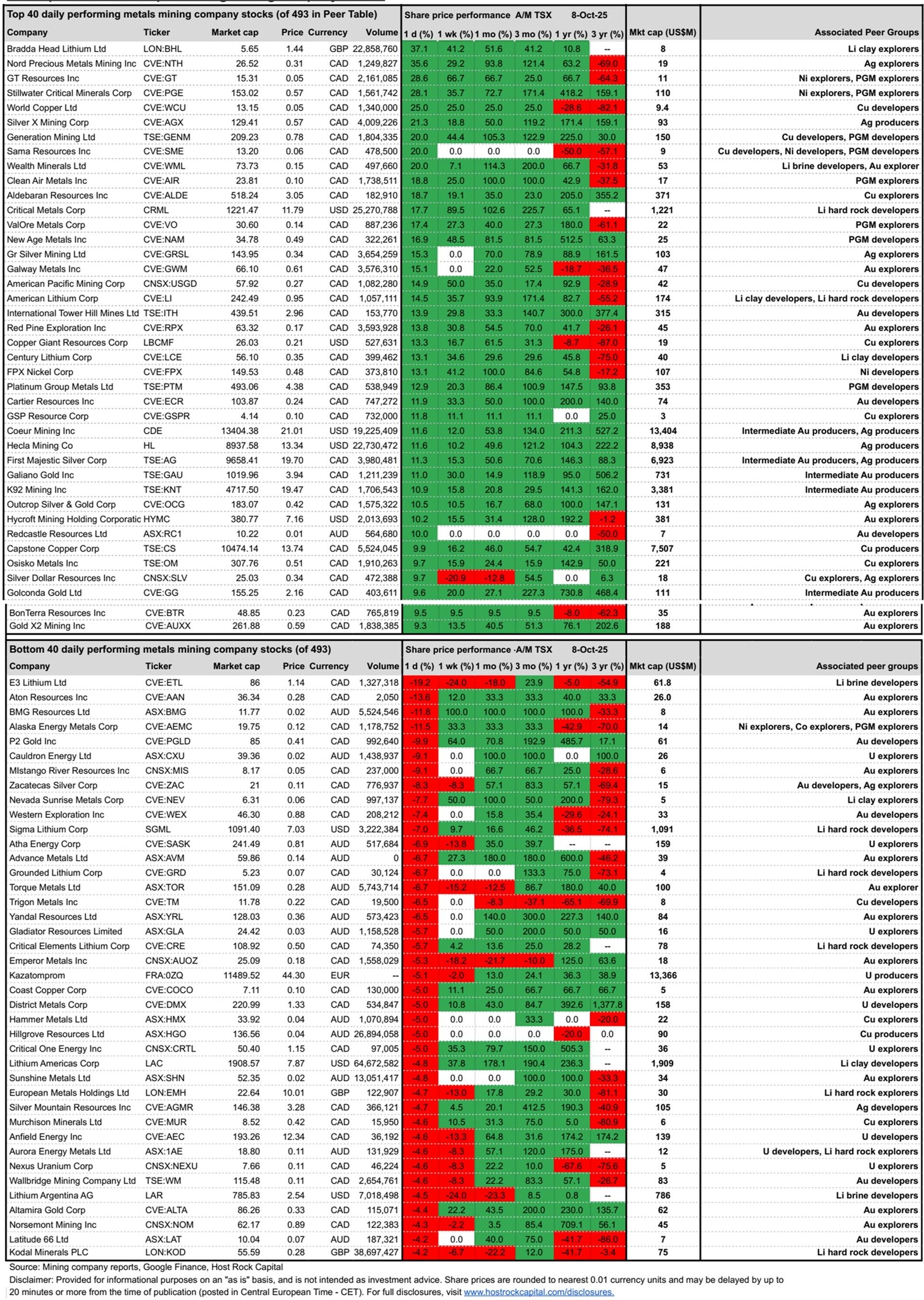

Top and bottom 40 daily performing metals mining company stocks (out of 493 in our Peer Table) intraday TSX/NYSE trading (including earlier ASX closing prices) include:

Covered mining company announcements incorporated into today’s after-market TSX Peer Table (resource updates, economic studies, changes in attributable project ownership):

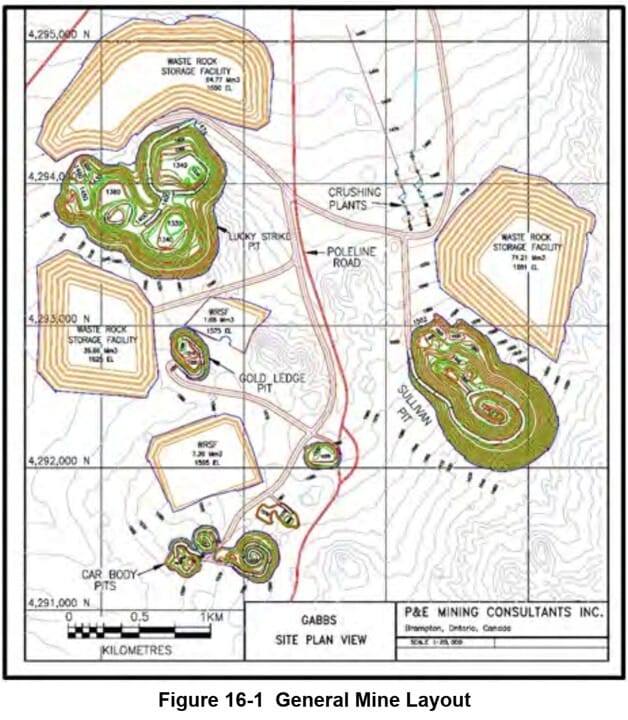

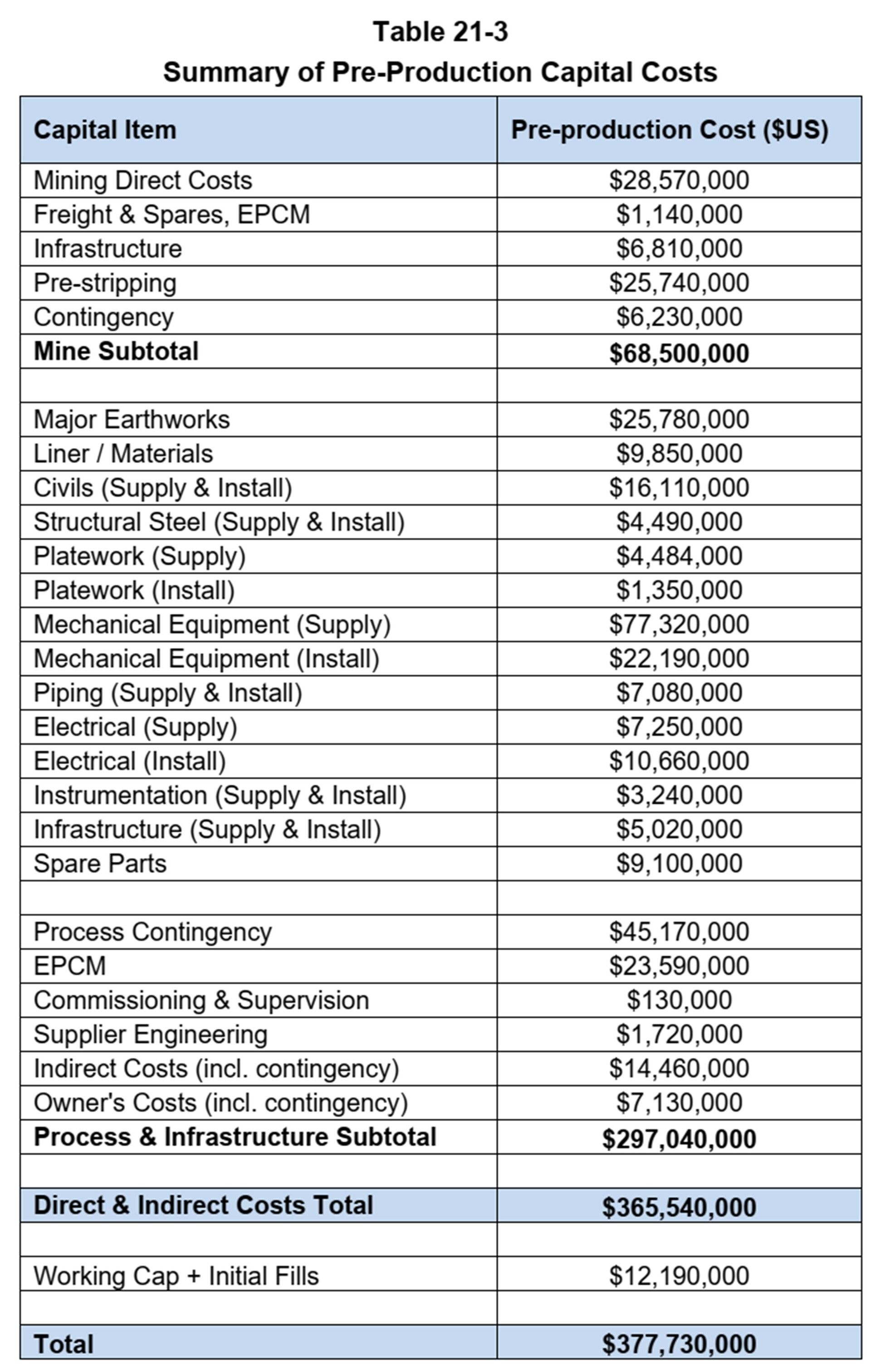

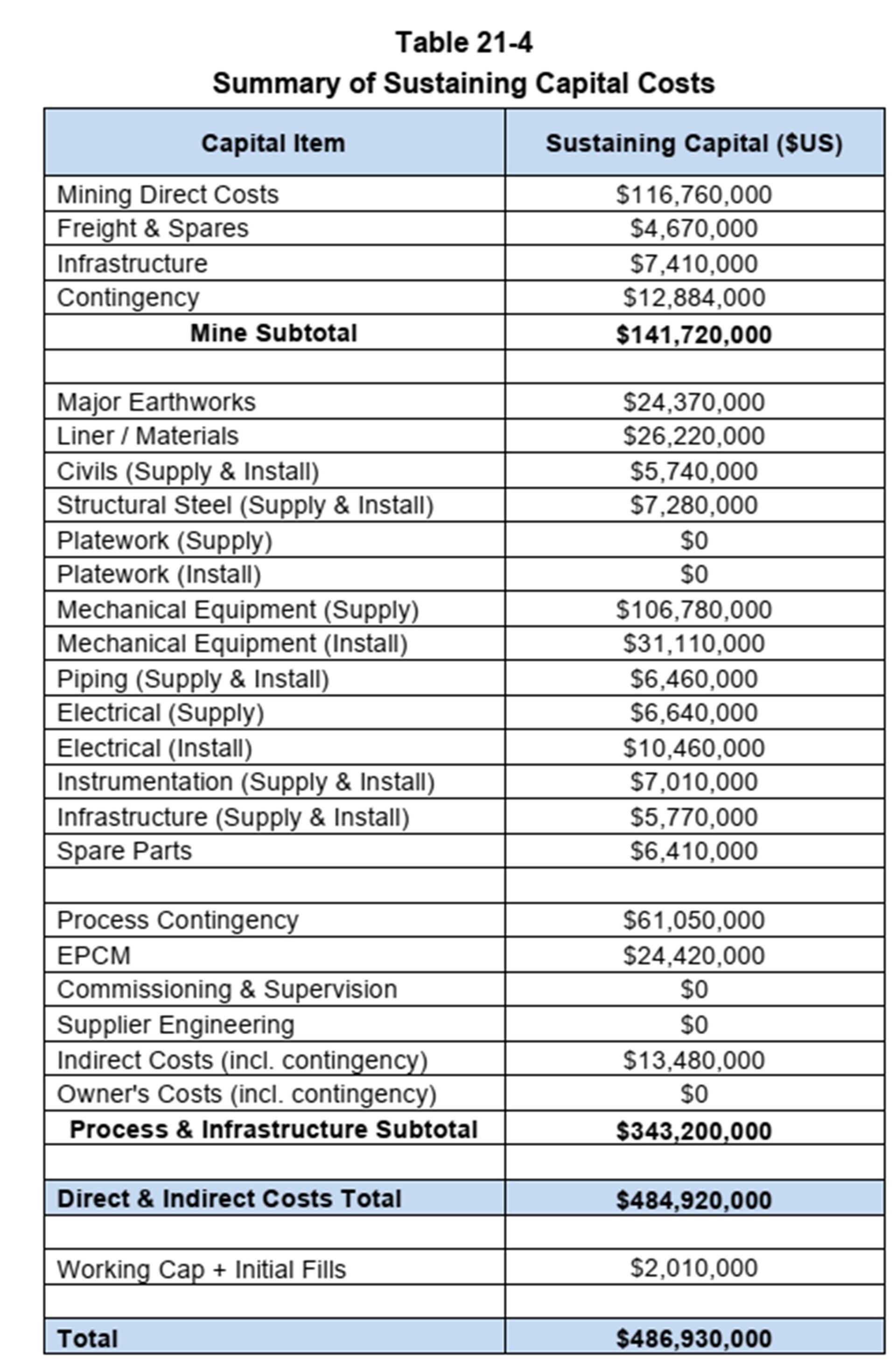

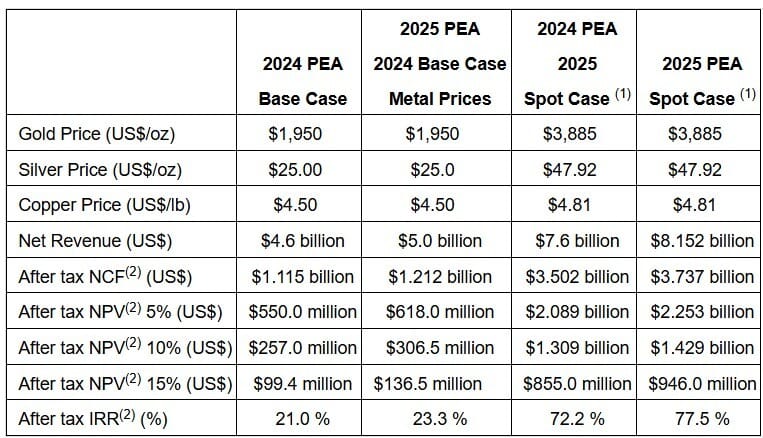

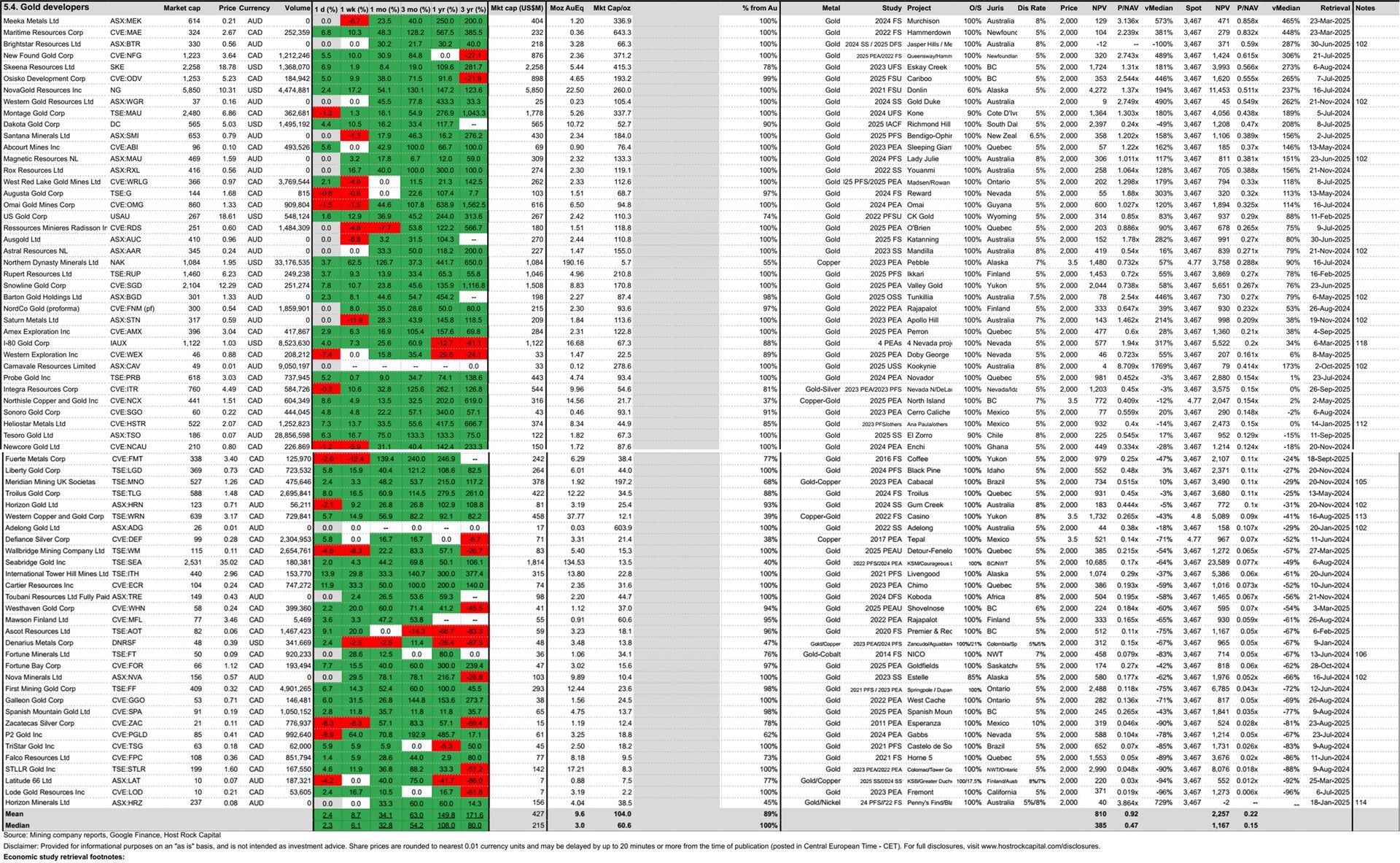

7 Oct 2025 - Gold developer P2 Gold (TSXV:PGLD) announced an updated PEA for its 100%-owned Gabbs gold-copper project in Nevada along its prolific Walker’s Lane trend. The press release quite clearly and transparently states everything is the same as the 2024 PEA (9mtpa oxide heap leach + SART + ADR operation for 5 years, before adding a 4mtpa mill in year 6 for sulfides, at which time oxide heap leach decreases to 5 mpta, for constant 9 mpta in total), except for the heap leach recoveries, which increased to 85% (from 78%) for gold, to 67% (from 54%) for copper, and to 60% (from 45%) for the trace silver, as a result of the phase 3 met test work (see news release dated 11 Aug 2025) which used more cyanide. These subtantial increases to heap leach recoveries translated to a slight improvement in economics compared to the 2024 PEA, despite capex and opex both increasing slightly. Reported post-tax NPV at reported spot of $3,885/oz was US$2.25b (up 8% from $2.1b in last study) from initial capex of US$383m. HOWEVER, the mine plan in the 2024 had been preliminary, and states that waste rock storage facilities had not been designed in detail. FURTHERMORE, after a closer look at the 2024 PEA in an attempt to gage the additional pond area that would be required for the additional cyanide degredation, and the additional leach pad liner requirements for the higher cyanide concentration, we discovered that not only did the 2024 PEA omit costs and space for ponds, it did not not account for ANY leach pads, NOR did it account for the aformentioned dry stack tailings impoundment with conveyor belts. So while the folks at Kappes, Cassiday & Associates had improved the metal recoveries in the phase 3 test work in this PEA they prepared, the mine plan and infrastructure that had been prepared and provided by P&E Mining Consultants Inc. was not synced/updated (after it had already glossed over a number of key items making it quite light on capex). So this PEA’s reported initial capex of $383m can be expected to rise in future more refined studies. Heap Leach capex from the Golder Associates’ 2011 PEA for the Cerro Jumil project in Mexico (now called Esperanza gold project held by Zacatecas Silver TSXV:ZAC) was ~15-17% of initial capex. So perhaps leach pads will add some ~$70m in capex at Gabbs, and maybe tailings filter and additional ponds/liners will add another ~$50m (ball park), for a more realistic capex of $503m (~30% higher) that might be expected in a PFS / next study….which is inconsequential in the grand scheme relative to NPV of $2.25b (TOUCHE / GOOD SKATING!). PGLD trades at 41c/sh, market cap C$85m, and P/NAV (market cap/study NPV) of 0.10x at our reference gold price of US$2,000/oz - a 78% discount to our 69-company gold explorer peer group.

Disclaimer: Provided for informational and educational purposes on an “as-is” basis, and is not investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.